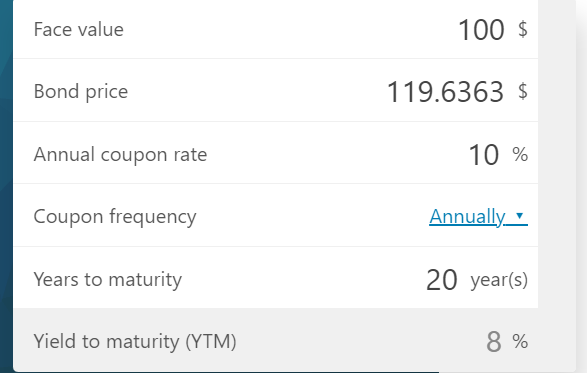

Question: Question : How does Yield to maturity equal 6.5 on the first picture? I used a YTM calculator online and inputted all the correct values

Question: How does Yield to maturity equal 6.5 on the first picture? I used a YTM calculator online and inputted all the correct values and I am deriving to 8% which is incorrect(by the way it is annual)

For Bond A: Coupon payment =10%$1000=$100 Bond price =$119.6363n=20 Using trial and error or a financial calculator, we can solve for i=6.5% Therefore, the YTM of Bond A is 6.5%. Face value 100$ Bond price 119.6363$ Annual coupon rate 10% Coupon frequency Years to maturity 20 year(s) Yield to maturity (YTM) 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts