Question: Please keep the question and answer private 2) Due to the recent decline in stock price, Apple is considering the following two mutually exclusive projects.

Please keep the question and answer private

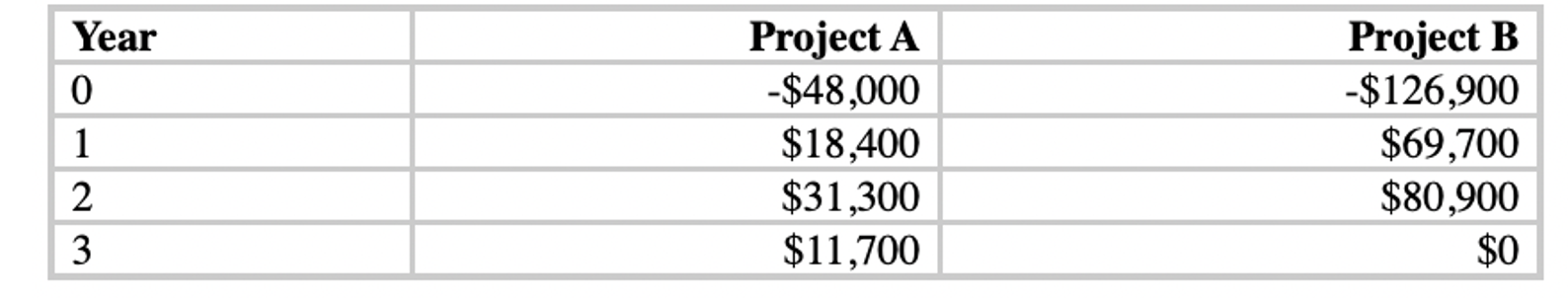

2) Due to the recent decline in stock price, Apple is considering the following two mutually exclusive projects. Suppose Apple currently has:

- 5,000 8-year, 6% semi-annual coupon bonds at par (face value = $1,000);

- 40,000 shares outstanding, price = $161.84.

- = 1.21. Market risk premium: 6%; Risk-free rate: 2%; Tax rate: 35%.

Which project should you accept and why?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts