Question: please kindly answer all. just write true or false. thanks in advance sir 1. In ratio analysis, you will never miss the forest for all

please kindly answer all. just write true or false. thanks in advance sir

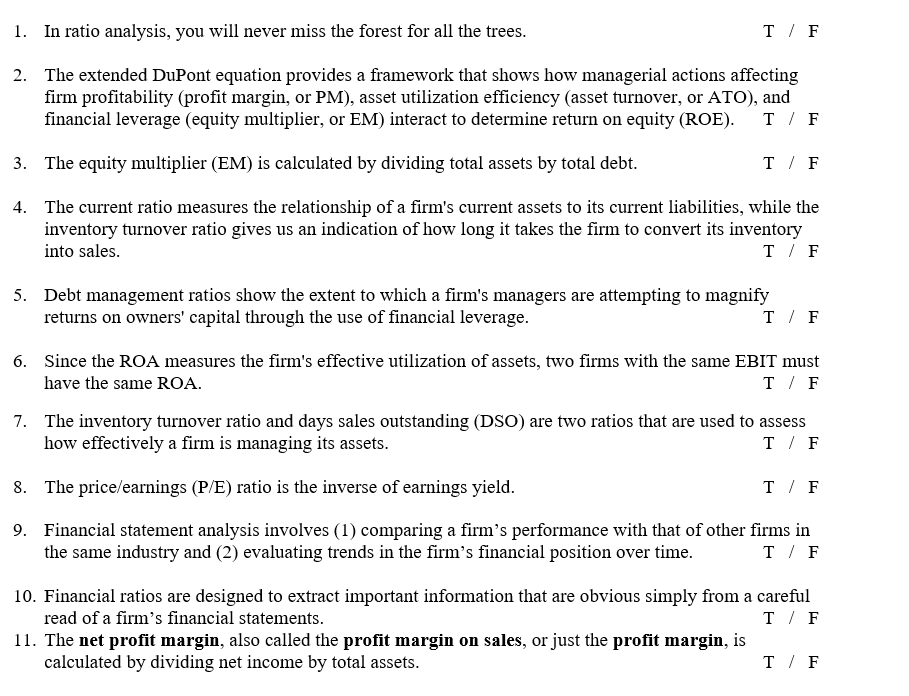

1. In ratio analysis, you will never miss the forest for all the trees. T / F 2. The extended DuPont equation provides a framework that shows how managerial actions affecting firm profitability (profit margin, or PM), asset utilization efficiency (asset turnover, or ATO), and financial leverage (equity multiplier, or EM) interact to determine return on equity (ROE). T / F 3. The equity multiplier (EM) is calculated by dividing total assets by total debt. T / F 4. The current ratio measures the relationship of a firm's current assets to its current liabilities, while the inventory turnover ratio gives us an indication of how long it takes the firm to convert its inventory into sales. T / F 5. Debt management ratios show the extent to which a firm's managers are attempting to magnify returns on owners' capital through the use of financial leverage. T/F 6. Since the ROA measures the firm's effective utilization of assets, two firms with the same EBIT must have the same ROA. T/F 7. The inventory turnover ratio and days sales outstanding (DSO) are two ratios that are used to assess how effectively a firm is managing its assets. T / F 8. The price/earnings (P/E) ratio is the inverse of earnings yield. T / F 9. Financial statement analysis involves (1) comparing a firm's performance with that of other firms in the same industry and (2) evaluating trends in the firm's financial position over time. TIF 10. Financial ratios are designed to extract important information that are obvious simply from a careful read of a firm's financial statements. T / F 11. The net profit margin, also called the profit margin on sales, or just the profit margin, is calculated by dividing net income by total assets. TIF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts