Question: please kindly answer all. just write true or false. thanks in advance sir 12. The current ratio and inventory turnover ratios both help us measure

please kindly answer all. just write true or false. thanks in advance sir

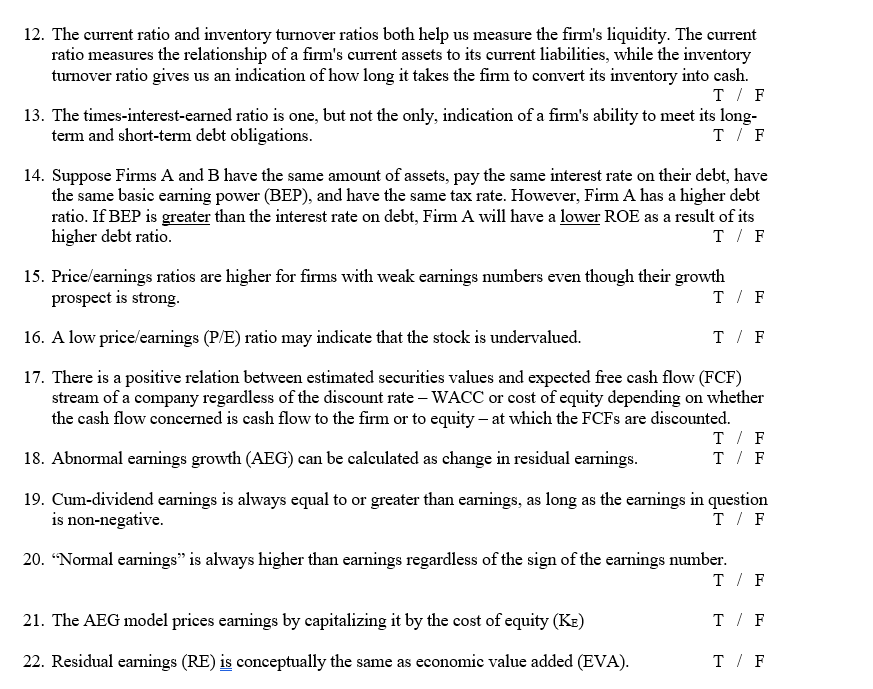

12. The current ratio and inventory turnover ratios both help us measure the firm's liquidity. The current ratio measures the relationship of a firm's current assets to its current liabilities, while the inventory turnover ratio gives us an indication of how long it takes the firm to convert its inventory into cash. T/F 13. The times-interest-earned ratio is one, but not the only, indication of a firm's ability to meet its long- term and short-term debt obligations. TIF 14. Suppose Firms A and B have the same amount of assets, pay the same interest rate on their debt, have the same basic earning power (BEP), and have the same tax rate. However, Firm A has a higher debt ratio. If BEP is greater than the interest rate on debt, Firm A will have a lower ROE as a result of its higher debt ratio. T / F 15. Price/earnings ratios are higher for firms with weak earnings numbers even though their growth prospect is strong. T / F 16. A low price/earnings (P/E) ratio may indicate that the stock is undervalued. T / F 17. There is a positive relation between estimated securities values and expected free cash flow (FCF) stream of a company regardless of the discount rate WACC or cost of equity depending on whether the cash flow concerned is cash flow to the firm or to equity - at which the FCFs are discounted. T / F 18. Abnormal earnings growth (AEG) can be calculated as change in residual earnings. T / F 19. Cum-dividend earnings is always equal to or greater than earnings, as long as the earnings in question is non-negative. TIF 20. "Normal earnings is always higher than earnings regardless of the sign of the earnings number. T / F 21. The AEG model prices earnings by capitalizing it by the cost of equity (KE) TIF 22. Residual earnings (RE) is conceptually the same as economic value added (EVA). T / F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts