Question: please kindly answer all please. just answer A,B,C or D, thanks in advance sir. 1. Judd Corporation has a weighted average cost of capital of

please kindly answer all please. just answer A,B,C or D, thanks in advance sir.

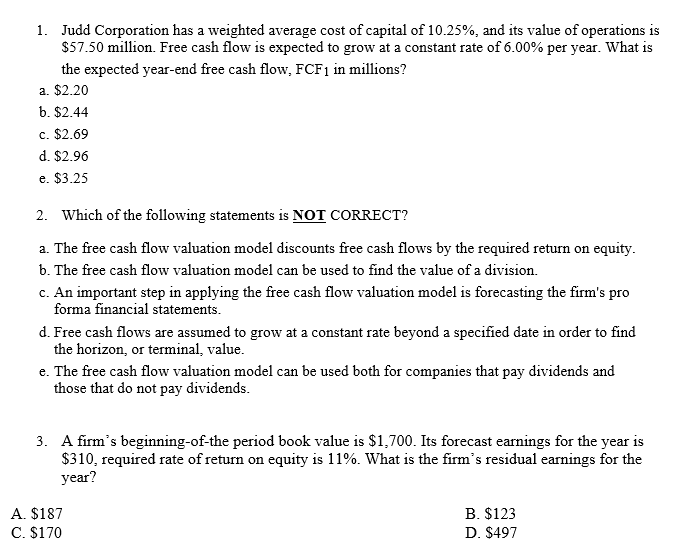

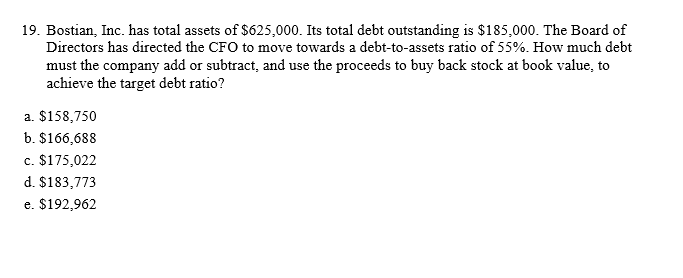

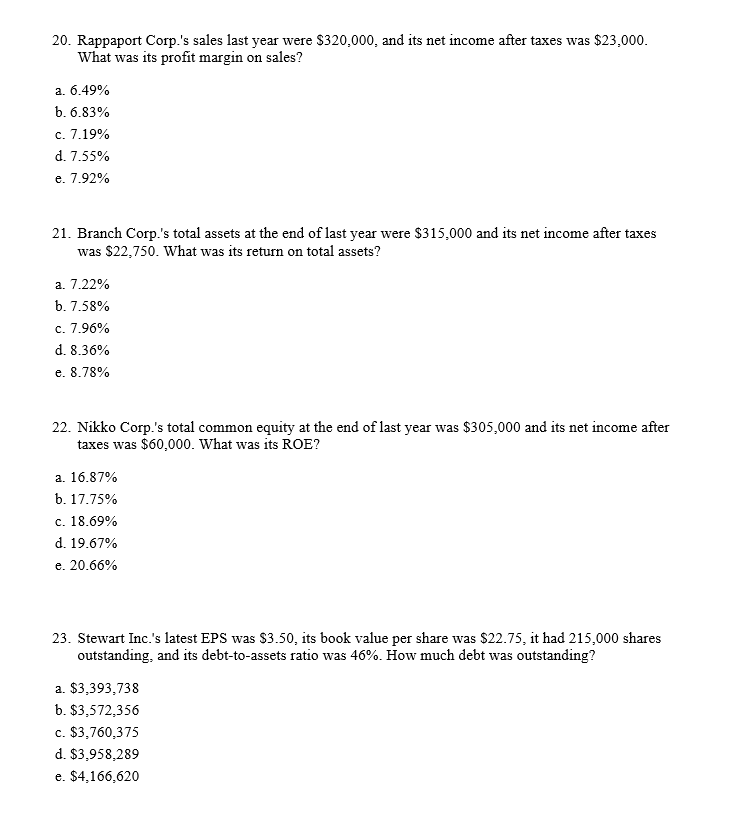

1. Judd Corporation has a weighted average cost of capital of 10.25%, and its value of operations is $57.50 million. Free cash flow is expected to grow at a constant rate of 6.00% per year. What is the expected year-end free cash flow, FCF1 in millions? a. $2.20 b. $2.44 c. $2.69 d. $2.96 e. $3.25 2. Which of the following statements is NOT CORRECT? a. The free cash flow valuation model discounts free cash flows by the required return on equity. b. The free cash flow valuation model can be used to find the value of a division. c. An important step in applying the free cash flow valuation model is forecasting the firm's pro forma financial statements. d. Free cash flows are assumed to grow at a constant rate beyond a specified date in order to find the horizon, or terminal, value. e. The free cash flow valuation model can be used both for companies that pay dividends and those that do not pay dividends. 3. A firm's beginning-of-the period book value is $1,700. Its forecast earnings for the year is $310, required rate of return on equity is 11%. What is the firm's residual earnings for the year? A. $187 C. $170 B. $123 D. $497 19. Bostian, Inc. has total assets of $625,000. Its total debt outstanding is $185,000. The Board of Directors has directed the CFO to move towards a debt-to-assets ratio of 55%. How much debt must the company add or subtract, and use the proceeds to buy back stock at book value, to achieve the target debt ratio? a. $158,750 b. $166,688 c. $175,022 d. $183,773 e. $192,962 20. Rappaport Corp.'s sales last year were $320,000, and its net income after taxes was $23.000. What was its profit margin on sales? a. 6.49% b. 6.83% c. 7.19% d. 7.55% e. 7.92% 21. Branch Corp.'s total assets at the end of last year were $315,000 and its net income after taxes was $22,750. What was its return on total assets? a. 7.22% 6.7.58% c. 7.96% d. 8.36% e. 8.78% 22. Nikko Corp.'s total common equity at the end of last year was $305,000 and its net income after taxes was $60,000. What was its ROE? a. 16.87% b. 17.75% c. 18.69% d. 19.67% e. 20.66% 23. Stewart Inc.'s latest EPS was $3.50, its book value per share was $22.75, it had 215,000 shares outstanding, and its debt-to-assets ratio was 46%. How much debt was outstanding? a. $3,393,738 b. $3,572,356 c. $3,760,375 d. $3,958,289 e. $4,166,620 24. Which of the following best articulates the Treasurer's rule? (C = Operating Cash Flow: I = Investing Cash Flow; d = Net Dividend; and F = Total Debt Financing Flows] A C-I=d-F B. C-I= d+F C. C+I=d-F D. C+I= d+F 25. Which of the following equations is the correct one to estimate expected net financial obligation, i.e., NFO,? [NFO = Net Financial Obligation; NFE = Net Financial Expense; FCF = Free Cash Flow; and d = Net dividend] A. NFO:-1 + NFE - FCF+ de B. NFO: + NFE - FCF+ de C. ANFO: + NFE:- FCFt + dt D. NFO:-1 + NFI. - FCFt + dt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts