Question: Please kindly show a step by step process. thanks. 4. Christina is single with a 12 year old daughter wh IS single with a 12

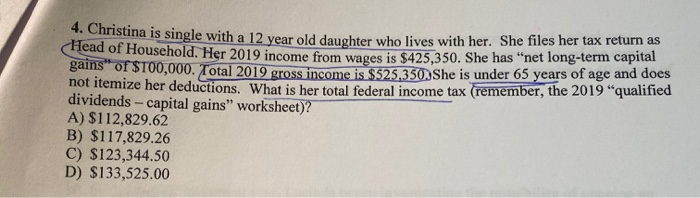

4. Christina is single with a 12 year old daughter wh IS single with a 12 year old daughter who lives with her. She files her tax return as tead of Household. Her 2019 income from wages is $425,350. She has "net long-term capital gains of $100,000. Total 2019 gross income is $525.350. She is under 65 years of age and does not itemize her deductions. What is her total federal income tax (remember, the 2019 quamed dividends - capital gains" worksheet)? A) $112,829.62 B) $117,829.26 C) $123,344.50 D) $133,525.00 4. Christina is single with a 12 year old daughter wh IS single with a 12 year old daughter who lives with her. She files her tax return as tead of Household. Her 2019 income from wages is $425,350. She has "net long-term capital gains of $100,000. Total 2019 gross income is $525.350. She is under 65 years of age and does not itemize her deductions. What is her total federal income tax (remember, the 2019 quamed dividends - capital gains" worksheet)? A) $112,829.62 B) $117,829.26 C) $123,344.50 D) $133,525.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts