Question: please kindly solve the question without using excel . Score: 0 of 1 pt 4 of 8 (8 complete) X Problem 4-95 (algorithmic) A cash

please kindly solve the question without using excel .

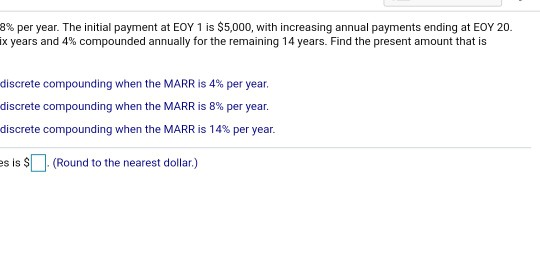

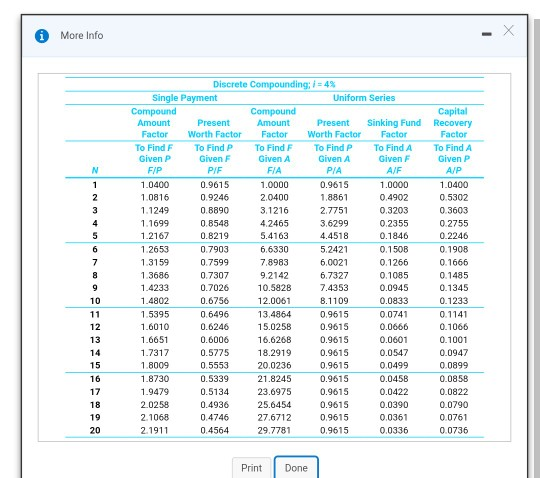

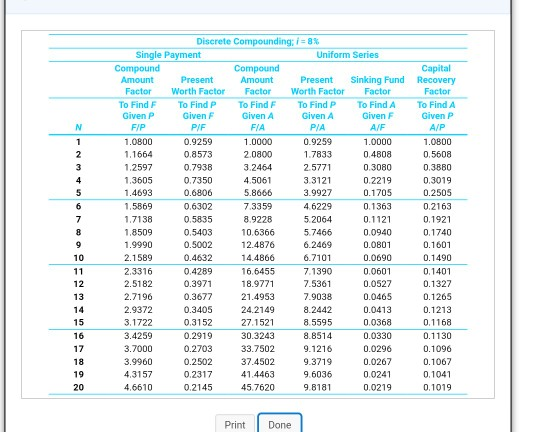

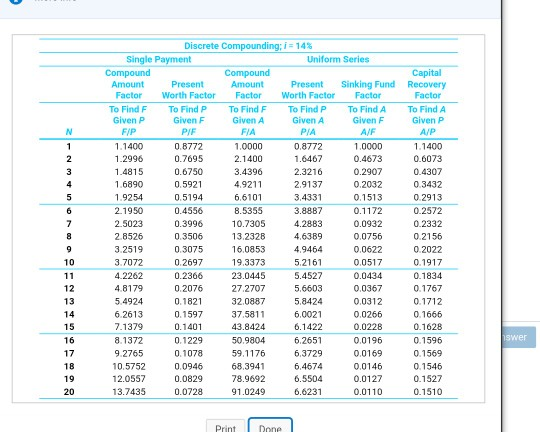

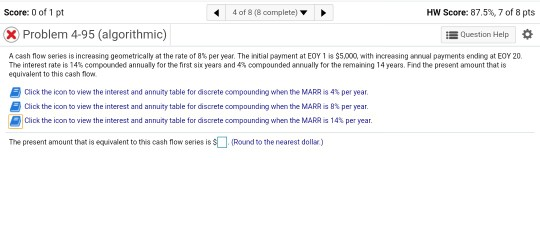

Score: 0 of 1 pt 4 of 8 (8 complete) X Problem 4-95 (algorithmic) A cash flow series is increasing geometrically at the rate of 8% per year. The initial payment at EOY 1 is $5 The interest rate is 14% compounded annually for the first six years and 4% compounded annually for the equivalent to this cash flow. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 4% Click the icon to view the interest and annuity table for discrete compounding when the MARR is 8% Click the icon to view the interest and annuity table for discrete compounding when the MARR is 149 The present amount that is equivalent to this cash flow series is $ . (Round to the nearest dollar.) 3% per year. The initial payment at EOY 1 is $5,000, with increasing annual payments ending at EOY 20. ix years and 4% compounded annually for the remaining 14 years. Find the present amount that is discrete compounding when the MARR is 4% per year. discrete compounding when the MARR is 8% per year. discrete compounding when the MARR is 14% per year. 7s is $ (Round to the nearest dollar) i More Info Capital Recovery Factor To Find A Given P AIP COUW N- Discrete Compounding; i = 4% Single Payment Uniform Series Compound Compound Amount Present Amount Present Sinking Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given Given A Given A Given F FIP PIF FIA PIA AF 1.0400 0.9615 1.0000 0.9615 1.0000 1.0816 0.9246 2.0400 1.8861 0.4902 1.1249 0.8890 3.1216 2.7751 0.3203 1.1699 0.8548 4.2465 3.6299 0.2355 1.2167 0.8219 5.4163 4.4518 0.1846 1.2653 0.7903 6.6330 5.2421 0.1508 1.3159 0.7599 7.8983 6.0021 0.1266 1.3686 0.7307 9.2142 6.7327 0.1085 1.4233 0.7026 10.5828 7.4353 0.0945 1.4802 0.6756 12.0061 8.1109 0.0833 1.5395 0.6496 13.4864 0.9615 0.0741 1.6010 0.6246 15.0258 0.9615 0.0666 1.6651 0.6006 16.626B 0.9615 0.0601 1.7317 0.5775 18.2919 0.9615 0.0547 1.8009 0.5553 20.0236 0.9615 0.0499 1.8730 0.5339 21.8245 0.9615 0.0458 1.9479 0.5134 23.6975 0.9615 0.0422 2.0258 0.4936 25.6454 0.9615 0.0390 2.1068 0.4746 27.6712 0.9615 0.0361 2.1911 0.4564 29.7781 0.9615 0.0336 1.0400 0.5302 0.3603 0.2755 0.2246 0.1908 0.1666 0.1485 0.1345 0.1233 0.1141 0.1066 0.1001 0.0947 0.0899 0.0858 0.0822 0.0790 0.0761 0.0736 Print Done AIF Discrete Compounding i = 8 Single Payment Uniform Series Compound Compound Amount Present Amount Present Sinking Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given Given P/F FIA PIA 1.0800 0.9259 1.0000 0.9259 1.0000 1.1664 0.8573 2.0800 1.7833 0.4808 1.2597 0.7938 3.2464 2.5771 0.3080 1.3605 0.7350 4.5061 3.3121 0.2219 1.4693 0.6806 5.8666 3.9927 0.1705 1.5869 0.6302 7.3359 4.6229 0.1363 1.7138 0.5835 8.9228 5.2064 0.1121 1.8509 0.5403 10.6366 5.7466 0.0940 1.9990 0.5002 12.4876 6.2469 0.0801 2.1589 0.4632 14.4866 6.7101 0.0690 2.3316 0.4289 16.6455 7.1390 0.0601 2.5182 0.3971 18.9771 7.5361 0.0527 2.7196 0.3677 21.4953 7.9038 0.0465 2.9372 0.3405 24.2149 8.2442 0.0413 3.1722 0.3152 27.1521 8.5595 0.0368 3.4259 0.2919 30.3243 8.8514 0.0330 3.7000 0.2703 33.7502 9.1216 0.0296 3.9960 0.2502 37.4502 9.3719 0.0267 4.3157 0.2317 41.4463 9.6036 0.0241 4.6610 0.2145 45.7620 9.8181 0.0219 Capital Recovery Factor To Find A Given P A/P 1.0800 0.5608 0.3880 0.3019 0.2505 0.2163 0.1921 0.1740 0.1601 0.1490 0.1401 0.1327 0.1265 0.1213 0.1168 0.1130 0.1096 0.1067 0.1041 0.1019 Print Done AP Discrete Compounding; i = 14% Single Payment Uniform Series Compound Compound Capital Amount Present Amount Present Sinking Fund Recovery Factor Worth Factor Factor Worth Factor Factor Factor To Find F To Find P To Find F To Find P To Find A To Find A Given P Given F Given A Given A Given F Given P F/P P/F FIA P/A A/F 1.1400 0.8772 1.0000 0.8772 1.0000 1.1400 1.2996 0.7695 2.1400 1.6467 0.4673 0.6073 1.4815 0.6750 3.4396 2.3216 0.2907 0.4307 1.6890 0.5921 4.9211 2.9137 0.2032 0.3432 1.9254 0.5194 6.6101 3.4331 0.1513 0.2913 2.1950 0.4556 8.5355 3.8887 0.1172 0.2572 2.5023 0.3996 10.7305 4.2883 0.0932 0.2332 2.8526 0.3506 13.2328 4.6389 0.0756 02156 3.2519 0.3075 16.0853 4.9464 0.0622 0.2022 3.7072 0.2697 19.3373 5.2161 0.0517 0.1917 4 2262 0.2366 23.0445 5.4527 0.0434 0.1834 4.8179 0.2076 27.2707 5.6603 0.0367 0.1767 5.4924 0.1821 32.0887 5.8424 0.0312 0.1712 6.2613 0.1597 37.5811 6.0021 0.0266 0.1666 7.1379 0.1401 43.8424 6.1422 0.0228 0.1628 8.1372 0.1229 50.9804 6.2651 0.0196 0.1596 9.2765 0.1078 59.1176 6.3729 0.0169 0.1569 10.5752 0.0946 68.3941 6.4674 0.0146 0.1546 12.0557 0.0829 78.9692 6.5504 0.0127 0.1527 13.7435 0.0728 91.0249 6 .6231 0.0110 0.1510 wer 20 Print Done Score: 0 of 1 pt 4 of 8 (8 complete) HW Score: 87.5%, 7 of 8 pts X Problem 4-95 (algorithmic) Question Help A cash flow series is increasing geometrically at the rate of 8% per year. The wtial payment at EOY 1 $5,000, with increasing annual payments ending at EOY 20 The interest rate is 14 compounded annually for the first six years and 4 compounded annually for the remaining 14 years. Find the present amount that is equivalent to this cash flow Click the icon to view the interest and annuity table for discrete compounding when the MARA is 4 per year Click the icon to view the interest and annuity table for discrete compounding when the MARA is 8 per year. Click the icon to view the interest and annuity table for discrete compounding when the MARA is 14 per year. The present amount that is equivalent to this cash flow series is Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts