Question: PLEASE LABEL AND ANSWER ALL QUESTIONS CORRECTLY WITH THE CORRESPONDING QUESTION ALL THE DROP DOWN QUESTIONS OPTIONS ARE CALL or PUT UNTIL YOU ANSWER THE

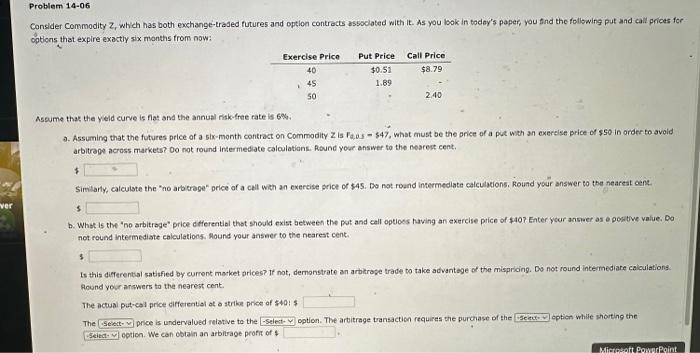

Consider Commodity Z,which has both exchange-traded futures and option contracts assoclated with it. As you look in taday's paper, you find the following put and call prices fer options that expire exactly six months trom now: Aseume that the yeld curve is fat and the annual riskefree rate is 6% i a. Assuming that the futures price of a six-month contract on Commodity Z is Fe.0. $47, what must be the orice of a put with an exereise price of $50 in order to avoid arbitrage across markets? 00 not round intermediate caloulatians. Round your answer to the nearent cent. 1 Simlarly, calculate the "no arberage" price of a cell with an cxercise orice of \$45. Do not roend intermedlate calculations. Round your answer to the nearest cent. 5 b. What is the "no arbitrage" price diflerential that showld exist between the pat and call optioes having an exercise price of 4o? Enter ycur ansier as e post tive value, Do not round intermediate colculetions. Mound your anseer to the nearest cent. 5 Is this diferental satisfied by current market prices? if not, dermonstrate an arbitrage trade to take advantege of the misprioing. Do not round inte mediate calculationg. Round your answers to the nearest cent. The actual put-cal price cifferential at a strike price of s40:s The price is undervalued relative to the option. The artitrage vansaction requires the purchase of the option while shorting the eption. We con obtain an arbiltage proft of \&

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts