Question: PLEASE LABEL AND ANSWER QUESTIONS 1, 2, and 3. Straight Line... and Effective Interest for Schedule new lease accounting rules apply C. On January 1,

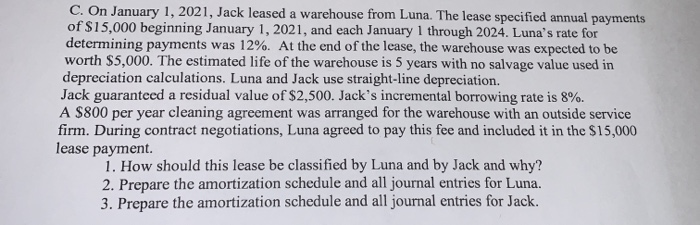

C. On January 1, 2021, Jack leased a warehouse from Luna. The lease specified annual payments of $15,000 beginning January 1, 2021, and each January 1 through 2024. Luna's rate for determining payments was 12%. At the end of the lease, the warehouse was expected to be worth $5,000. The estimated life of the warehouse is 5 years with no salvage value used in depreciation calculations. Luna and Jack use straight-line depreciation. Jack guaranteed a residual value of $2,500. Jack's incremental borrowing rate is 8%. A $800 per year cleaning agreement was arranged for the warehouse with an outside service firm. During contract negotiations, Luna agreed to pay this fee and included it in the $15,000 lease payment 1. How should this lease be classified by Luna and by Jack and why? 2. Prepare the amortization schedule and all journal entries for Luna. 3. Prepare the amortization schedule and all journal entries for Jack

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts