Question: please let me know as soon as possible!!!! 8. The Anglo Enterprises has 8% coupon bonds on the market that have 10 years left to

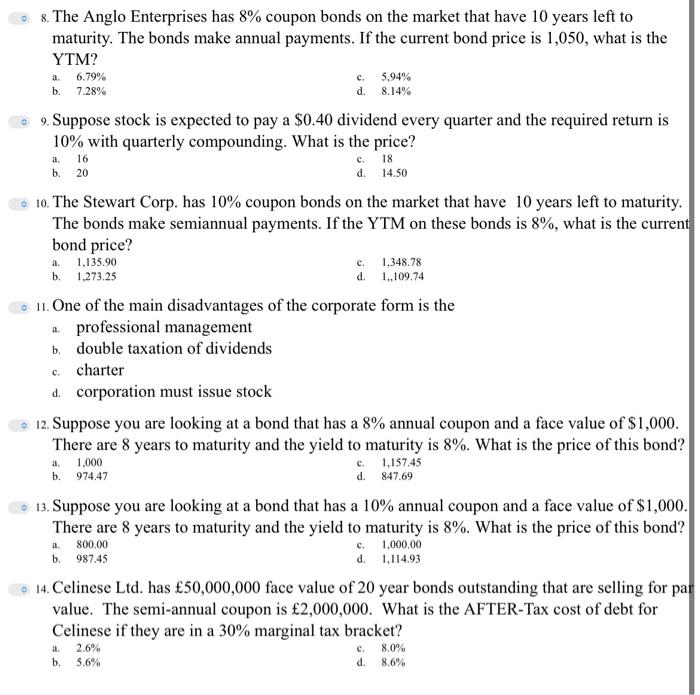

8. The Anglo Enterprises has 8% coupon bonds on the market that have 10 years left to maturity. The bonds make annual payments. If the current bond price is 1,050 , what is the YTM? a. 6.79% c. 5,94% b. 7.28% d. 8.14% - 9. Suppose stock is expected to pay a $0.40 dividend every quarter and the required return is 10% with quarterly compounding. What is the price? a.b.1620 c.d.1814.50 10. The Stewart Corp. has 10% coupon bonds on the market that have 10 years left to maturity. The bonds make semiannual payments. If the YTM on these bonds is 8%, what is the current bond price? a. 1,135.90 c. 1,348.78 b. 1,273.25 d. 1,109.74 11. One of the main disadvantages of the corporate form is the a. professional management b. double taxation of dividends c. charter d. corporation must issue stock - 12. Suppose you are looking at a bond that has a 8\% annual coupon and a face value of $1,000. There are 8 years to maturity and the yield to maturity is 8%. What is the price of this bond? a.b.1,000974.47 c. 1,157.45 b. 974.47 d. 847.69 - 13. Suppose you are looking at a bond that has a 10% annual coupon and a face value of $1,000. There are 8 years to maturity and the yield to maturity is 8%. What is the price of this bond? a. 800.00 c. 1,000,00 b. 987.45 d. 1,114.93 14. Celinese Ltd. has 50,000,000 face value of 20 year bonds outstanding that are selling for pa value. The semi-annual coupon is 2,000,000. What is the AFTER-Tax cost of debt for Celinese if they are in a 30% marginal tax bracket? a. 2.6% c. 8.0% b. 5.6% d. 8.6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts