Question: Please let me know if anything else is needed in answering question, thank you! Country Cost Spot Rate 6-Month Forward Rate Switzerland F66,151,533 $1.0488/1F $1.0685/1F

Please let me know if anything else is needed in answering question, thank you!

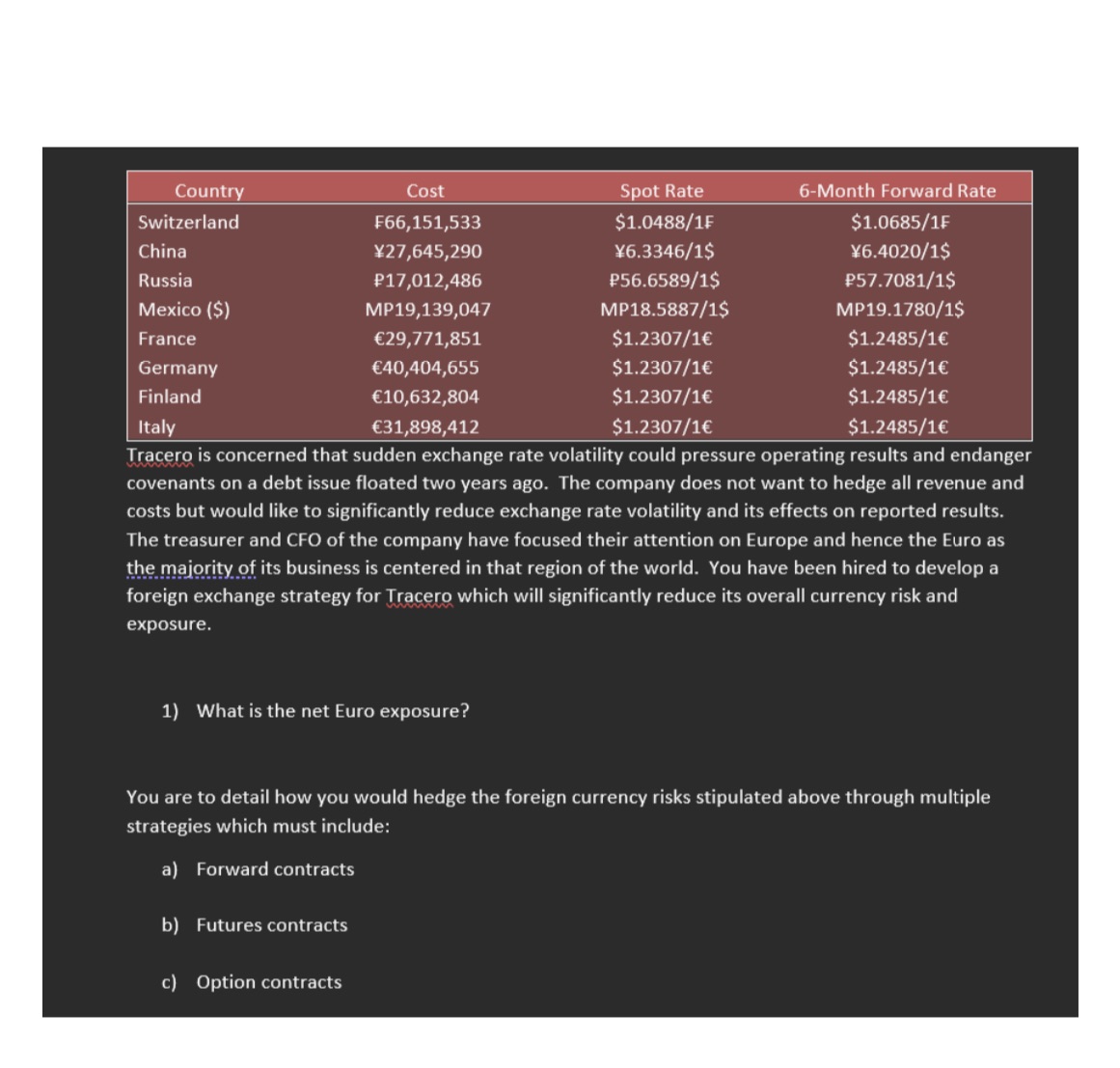

Country Cost Spot Rate 6-Month Forward Rate Switzerland F66,151,533 $1.0488/1F $1.0685/1F China X27,645,290 Y6.3346/1$ Y6.4020/1$ Russia P17,012,486 P56.6589/1$ P57.7081/1$ Mexico ($) MP19,139,047 MP18.5887/1$ MP19.1780/1$ France (29,771,851 $1.2307/1E $1.2485/1E Germany (40,404,655 $1.2307/16 $1.2485/1E Finland (10,632,804 $1.2307/1E $1.2485/1E Italy E31,898,412 $1.2307/1E $1.2485/16 Tracero is concerned that sudden exchange rate volatility could pressure operating results and endanger covenants on a debt issue floated two years ago. The company does not want to hedge all revenue and costs but would like to significantly reduce exchange rate volatility and its effects on reported results. The treasurer and CFO of the company have focused their attention on Europe and hence the Euro as the majority of its business is centered in that region of the world. You have been hired to develop a foreign exchange strategy for Tracero which will significantly reduce its overall currency risk and exposure. 1) What is the net Euro exposure? You are to detail how you would hedge the foreign currency risks stipulated above through multiple strategies which must include: a) Forward contracts b) Futures contracts c) Option contracts