Question: Please let me know if my answer is right. ACE is a wholly owned subsidiary of BASE. The unconsolidated statement of comprehensive income and the

Please let me know if my answer is right.

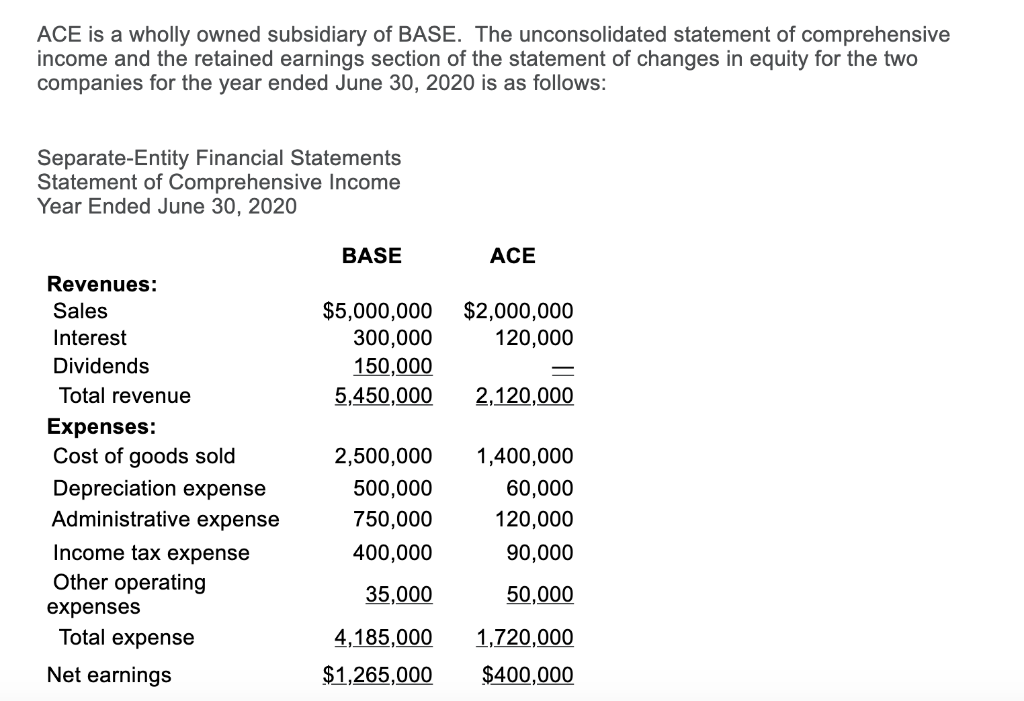

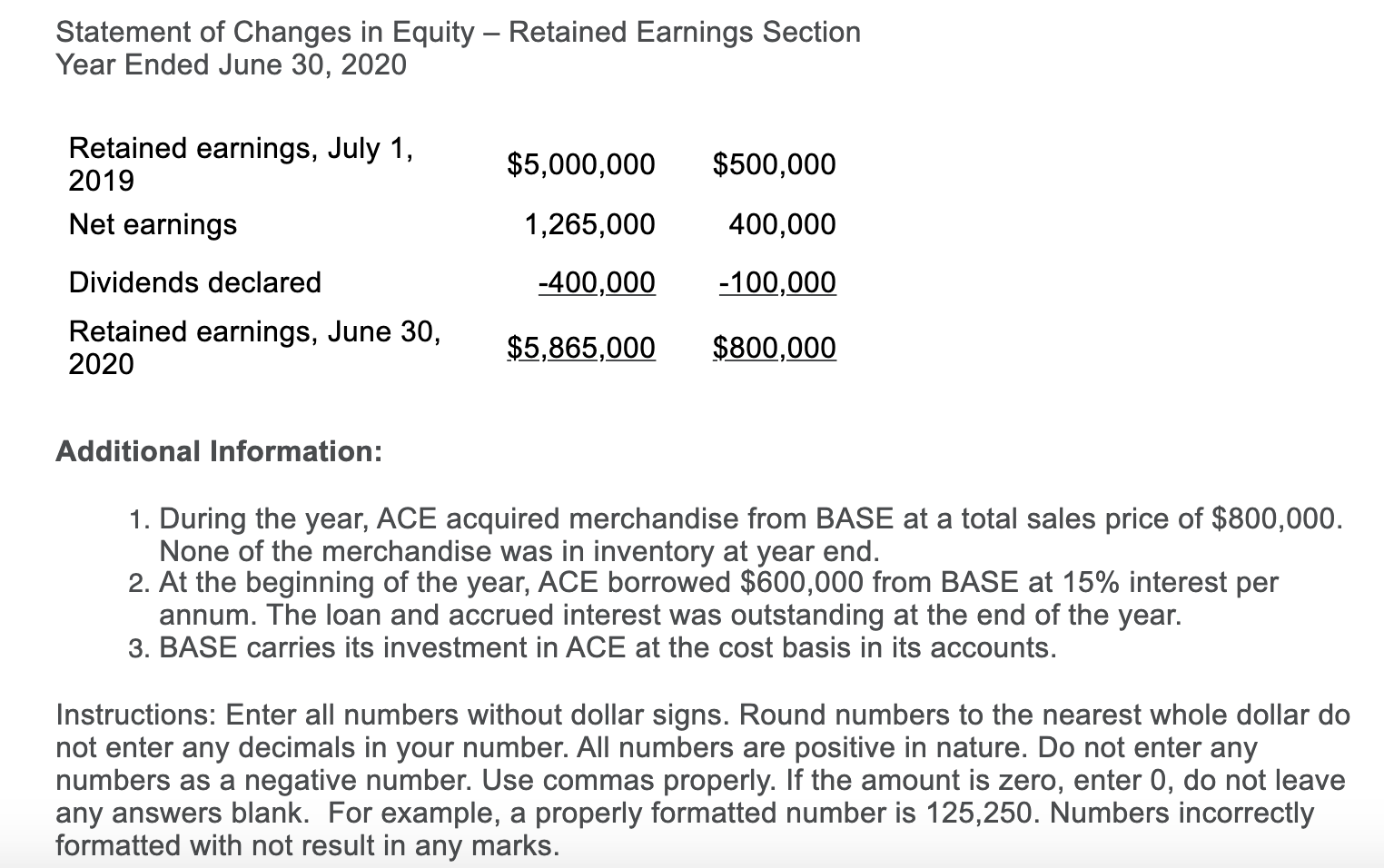

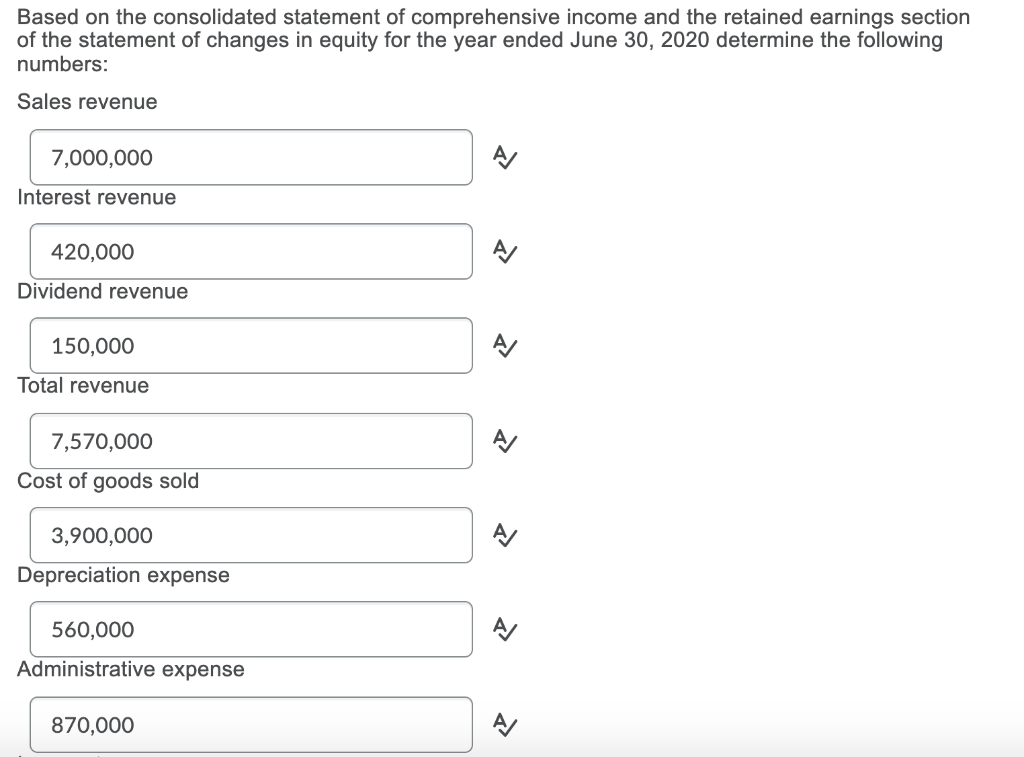

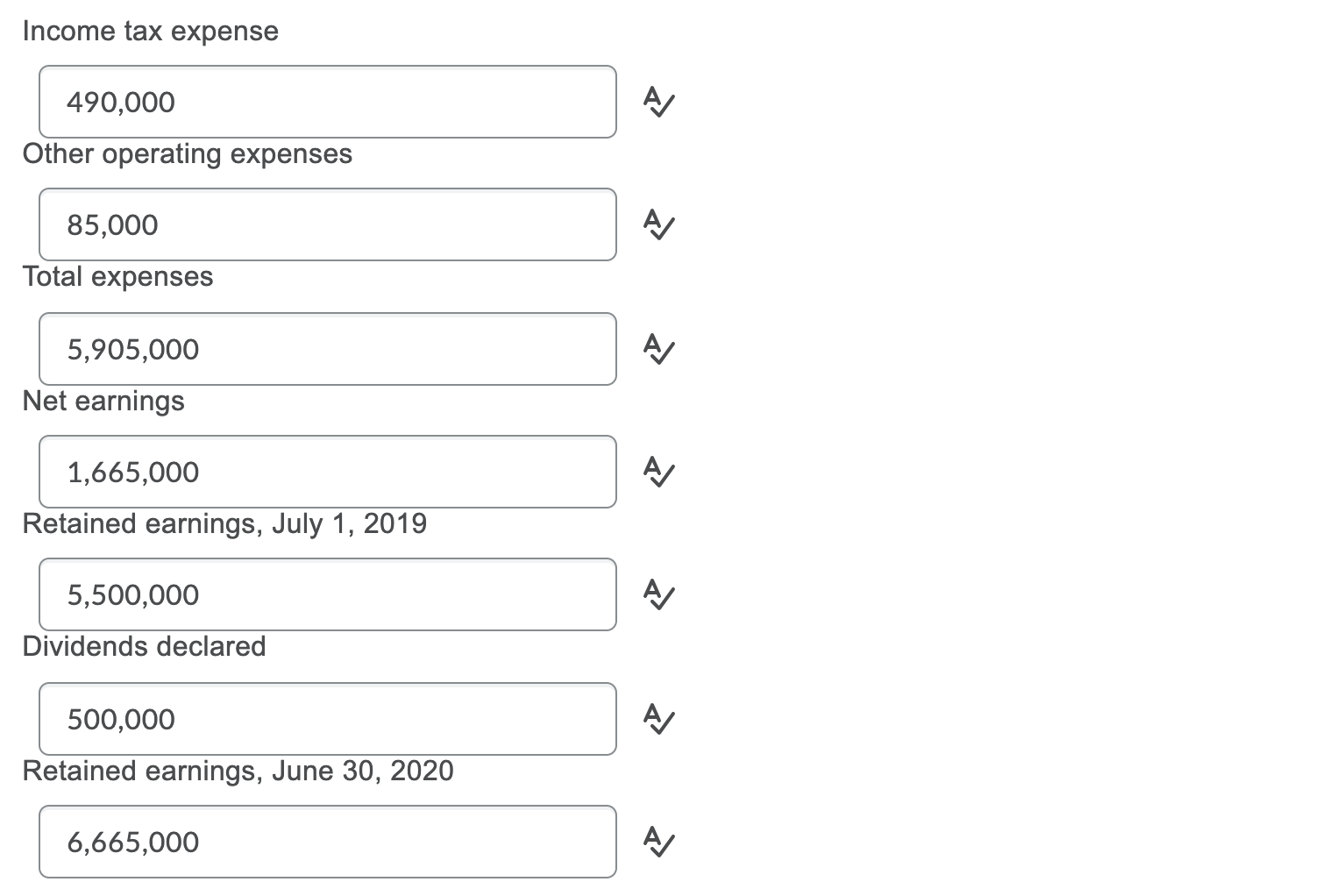

ACE is a wholly owned subsidiary of BASE. The unconsolidated statement of comprehensive income and the retained earnings section of the statement of changes in equity for the two companies for the year ended June 30, 2020 is as follows: Separate-Entity Financial Statements Statement of Comprehensive Income Year Ended June 30, 2020 BASE ACE $2,000,000 120,000 $5,000,000 300,000 150,000 5,450,000 2,120,000 Revenues: Sales Interest Dividends Total revenue Expenses: Cost of goods sold Depreciation expense Administrative expense Income tax expense Other operating expenses Total expense Net earnings 2,500,000 500,000 750,000 400,000 1,400,000 60,000 120,000 90,000 35,000 50,000 4,185,000 $1,265,000 1,720,000 $400,000 Statement of Changes in Equity Retained Earnings Section Year Ended June 30, 2020 $5,000,000 $500,000 Retained earnings, July 1, 2019 Net earnings 1,265,000 400,000 Dividends declared -400,000 -100,000 Retained earnings, June 30, 2020 $5,865,000 $800,000 Additional Information: 1. During the year, ACE acquired merchandise from BASE at a total sales price of $800,000. None of the merchandise was in inventory at year end. 2. At the beginning of the year, ACE borrowed $600,000 from BASE at 15% interest per annum. The loan and accrued interest was outstanding at the end of the year. 3. BASE carries its investment in ACE at the cost basis in its accounts. Instructions: Enter all numbers without dollar signs. Round numbers to the nearest whole dollar do not enter any decimals in your number. All numbers are positive in nature. Do not enter any numbers as a negative number. Use commas properly. If the amount is zero, enter 0, do not leave any answers blank. For example, a properly formatted number is 125,250. Numbers incorrectly formatted with not result in any marks. Based on the consolidated statement of comprehensive income and the retained earnings section of the statement of changes in equity for the year ended June 30, 2020 determine the following numbers: Sales revenue 7,000,000 A/ Interest revenue 420,000 A/ Dividend revenue 150,000 AJ Total revenue A 7,570,000 Cost of goods sold 3,900,000 Depreciation expense 560,000 AJ Administrative expense 870,000 Income tax expense 490,000 AV Other operating expenses 85,000 AJ Total expenses AJ 5,905,000 Net earnings A/ 1,665,000 Retained earnings, July 1, 2019 5,500,000 A/ Dividends declared 500,000 AJ Retained earnings, June 30, 2020 6,665,000 A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts