Question: Please list steps and explain how to work this problem. Thank you. [4 points] 30: You own land in Texas that may have oil on

Please list steps and explain how to work this problem. Thank you.

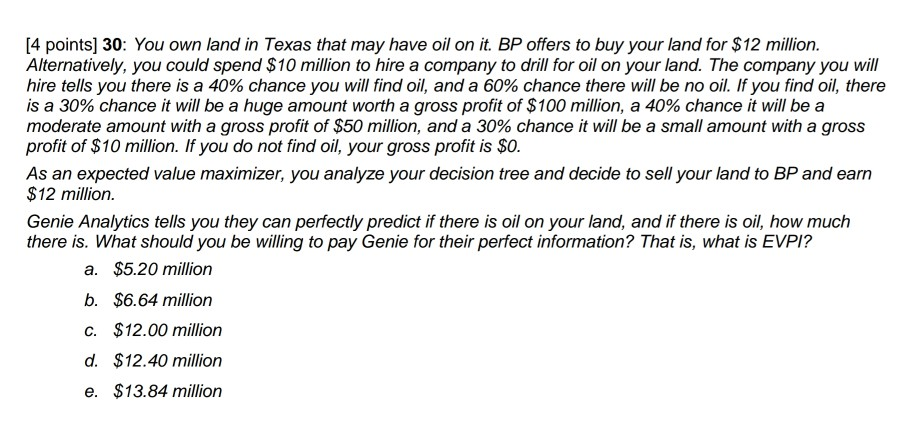

[4 points] 30: You own land in Texas that may have oil on it. BP offers to buy your land for $12 million. Alternatively, you could spend $10 million to hire a company to drill for oil on your land. The company you will hire tells you there is a 40% chance you will find oil, and a 60% chance there will be no oil. If you find oil, there is a 30% chance it will be a huge amount worth a gross profit of $100 million, a 40% chance it will be a moderate amount with a gross profit of $50 million, and a 30% chance it will be a small amount with a gross profit of $10 million. If you do not find oil, your gross profit is $0. As an expected value maximizer, you analyze your decision tree and decide to sell your land to BP and earn $12 million. Genie Analytics tells you they can perfectly predict if there is oil on your land, and if there is oil, how much there is. What should you be willing to pay Genie for their perfect information? That is what is EVPI? a. $5.20 million b. $6.64 million C. $12.00 million d. $12.40 million e. $13.84 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts