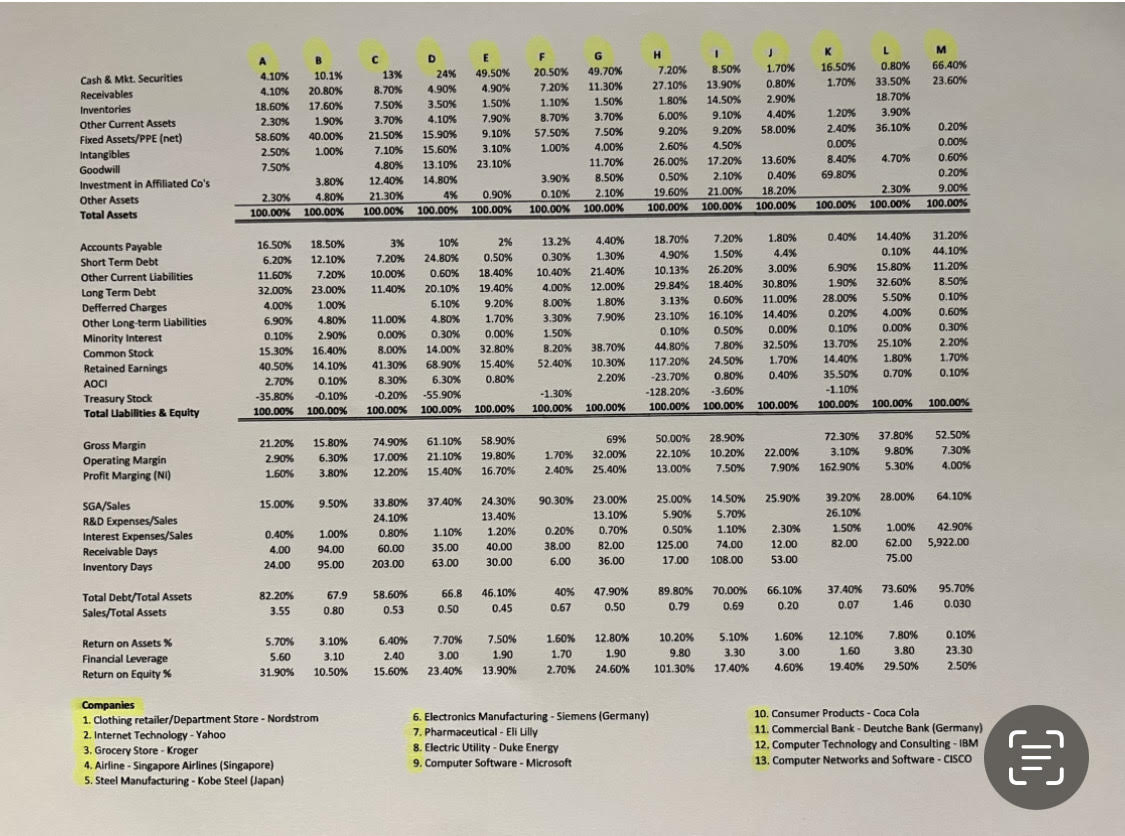

Question: Please look at the attached file (financial statement A~M) and companies (1-13) listed below. Q1. Is Yahoo(2) D ? Q2. Is Deutsche Bank(11) M ?

Please look at the attached file (financial statement A~M) and companies (1-13) listed below.

Q1. Is Yahoo(2) D?

Q2. Is Deutsche Bank(11) M?

Q3. Is Coca Cola(10) H?

Q4. Which ones (2 companies) are the companies with inventories but no margin?

Please give me your explanation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock