Question: Please look at the attached screenshot for the question Use these data for the following 3 questions Your firm is considering launching its new project

Please look at the attached screenshot for the question

Please look at the attached screenshot for the question

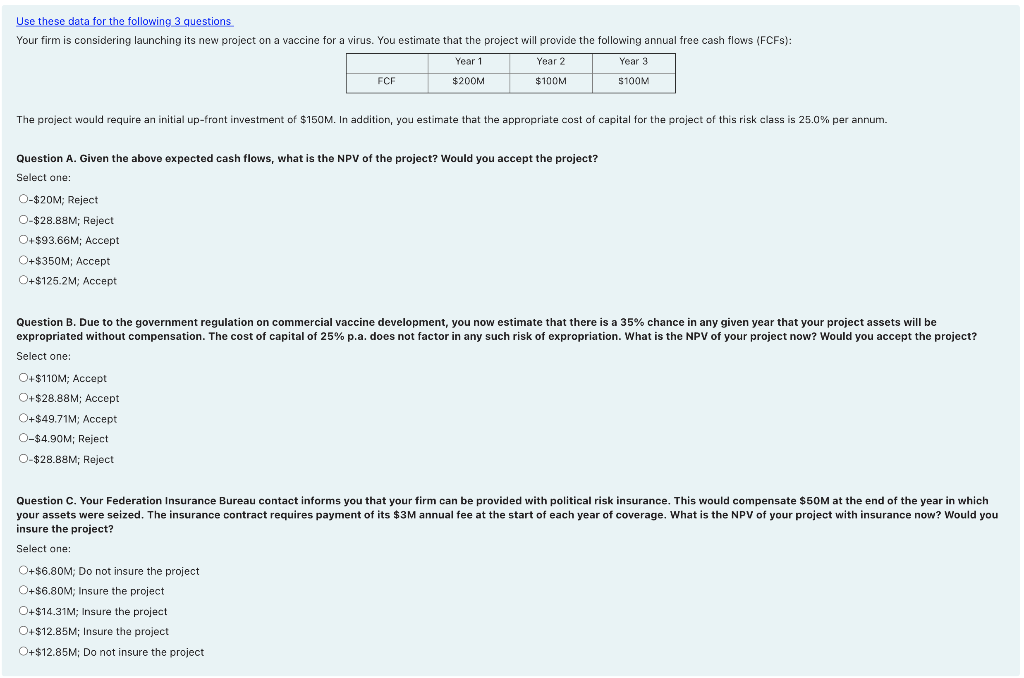

Use these data for the following 3 questions Your firm is considering launching its new project on a vaccine for a virus. You estimate that the project will provide the following annual free cash flows (FCFS): Year 1 Year 2 Year 3 FCF $200M $100M $100M The project would require an initial up-front investment of $150M. In addition, you estimate that the appropriate cost of capital for the project of this risk class is 25.0% per annum. Question A. Given the above expected cash flows, what is the NPV of the project? Would you accept the project? Select one: 0-$20M; Reject 0-$28.88M; Reject O+$93.66M; Accept O+$350M; Accept O+$125.2M; Accept Question B. Due to the government regulation on commercial vaccine development, you now estimate that there is a 35% chance in any given year that your project assets will be expropriated without compensation. The cost of capital of 25% p.a. does not factor in any such risk of expropriation. What is the NPV of your project now? Would you accept the project? Select one: O+$110M; Accept O+$28.88M; Accept O+$49.71M; Accept O-$4.90M; Reject 0-$28.88M; Reject Question C. Your Federation Insurance Bureau contact informs you that your firm can be provided with political risk insurance. This would compensate $50M at the end of the year in which your assets were seized. The insurance contract requires payment of its $3M annual fee at the start of each year of coverage. What is the NPV of your project with insurance now? Would you insure the project? Select one: O+$6.80M; Do not insure the project O+$6.80M; Insure the project O+$14.31M; Insure the project O+$12.85M; Insure the project O+$12.85M; Do not insure the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts