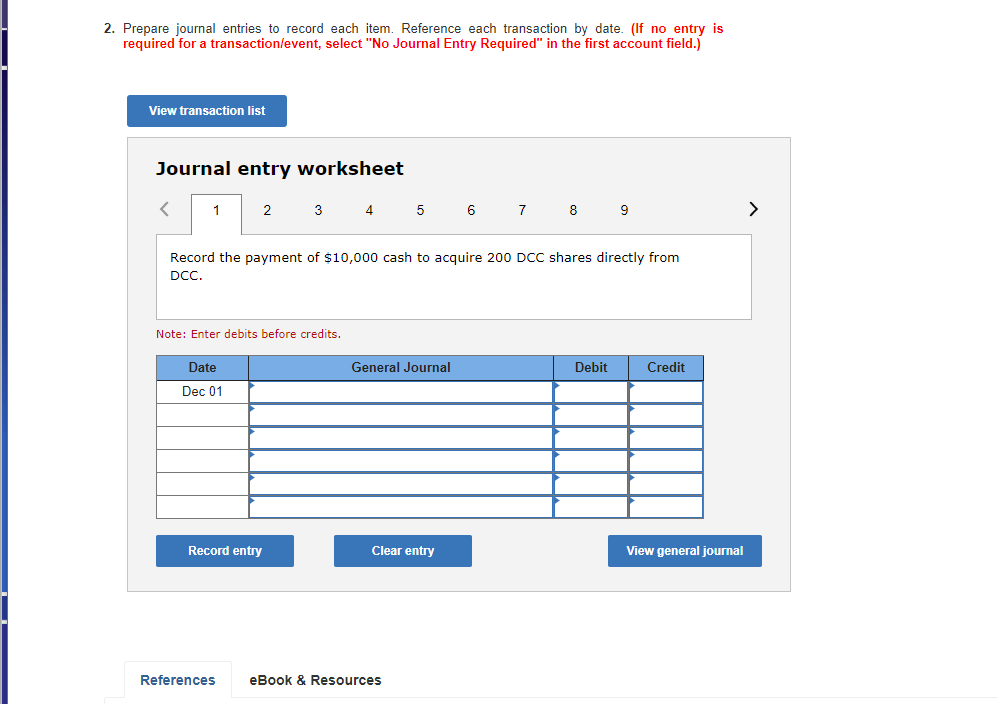

Question: Please make a journal entry for questions 1 - 9 1 Record the payment of $10,000 cash to acquire 200 DCC shares directly from DCC.

Please make a journal entry for questions 1 - 9

1

Record the payment of $10,000 cash to acquire 200 DCC shares directly from DCC.

2

Record the ordering of cleaning supplies at a total cost of $2,000. The supplies are expected to be received in early January.

3

Record the payment by customers $200 cash to DCC to obtain DCC gift cards that they could use to obtain future cleaning services at no additional cost.

4

Record the entry for running an advertisement in the local newspaper today at a total cost of $500. DCC is not required to pay for the advertising until January 21.

5

Record the payment of $1,000 to the landlord as rent for January.

6

Record the entry for sale by DCCs owner of 20 of his own DSS shares to a private investor, at a selling price of $1,200.

7

Record the payment in full for the advertisement run in the local newspaper on December 21.

8

Record the entry for supplies ordered on December 7 that were received today. DCC does not have to pay for these supplies until January 29.

9

Record the completion of cleaning services for several large companies at a total price of $2,000. The companies are expected to pay for the services by January 31.

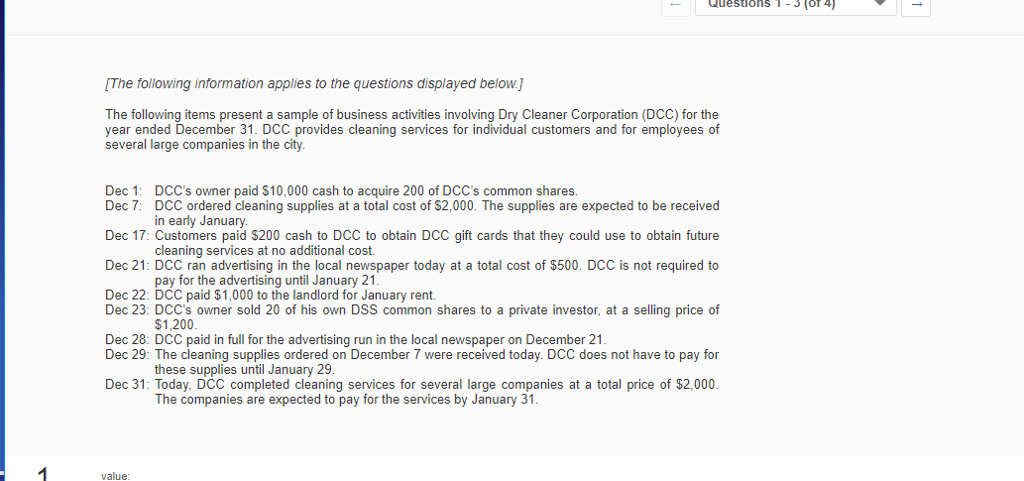

[The following information applies to the questions displayed belowj The following items present a sample of business activities involving Dry Cleaner Corporation (DCC) for the year ended December 31. DCC provides cleaning services for individual customers and for employees of several large companies in the city DCC's owner paid $10,000 cash to acquire 200 of DCC's common shares in early January cleaning services at no additional cost. pay for the advertising until January 21 Dec 1: Dec 7: DCC ordered cleaning supplies at a total cost of $2,000. The supplies are expected to be received Dec 17: Customers paid $200 cash to DCC to obtain DCC gift cards that they could use to obtain future Dec 21: DCC ran advertising in the local newspaper today at a total cost of $500. DCC is not required to Dec 22: DCC paid $1,000 to the landlord for January rent. Dec 23: DCC's owner sold 20 of his own DSS common shares to a private investor, at a selling price of $1,200 Dec 28: DCC paid in full for the advertising run in the local newspaper on December 21 Dec 29: The cleaning supplies ordered on December 7 were received today. DCC does not have to pay for these supplies until January 29 Dec 31: Today, DCC completed cleaning services for several large companies at a total price of $2,000 The companies are expected to pay for the services by January 31 value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts