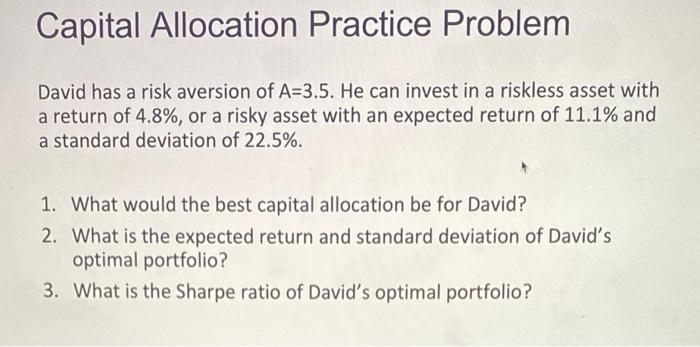

Question: please make steps clear thank you :) David has a risk aversion of A=3.5. He can invest in a riskless asset with a return of

David has a risk aversion of A=3.5. He can invest in a riskless asset with a return of 4.8%, or a risky asset with an expected return of 11.1% and a standard deviation of 22.5%. 1. What would the best capital allocation be for David? 2. What is the expected return and standard deviation of David's optimal portfolio? 3. What is the Sharpe ratio of David's optimal portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts