Question: Please make sure that you use formulas in Excel or type the answers on the Excel sheet. You and your spouse conclude that you would

Please make sure that you use formulas in Excel or type the answers on the Excel sheet.

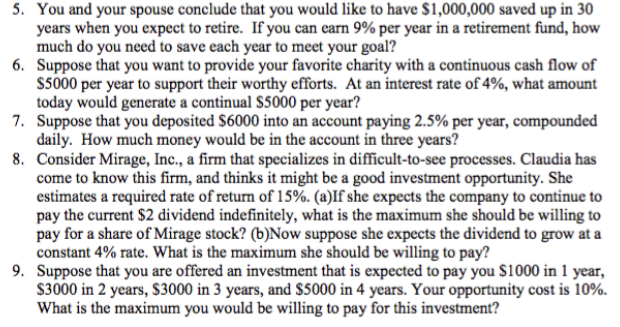

You and your spouse conclude that you would like to have $1,000,000 saved up in 30 years when you expect to retire. If you can earn 9% per year in a retirement fund, how much do you need to save each year to meet your goal? Suppose that you want to provide your favorite charity with a continuous cash flow of $5000 per year to support their worthy efforts. At an interest rate of 4%, what amount today would generate a continual $5000 per year? Suppose that you deposited $6000 into an account paying 2.5% per year, compounded daily. How much money would be in the account in three years? Consider Mirage, Inc., a firm that specializes in difficult-to-see processes. Claudia has come to know this firm, and thinks it might be a good investment opportunity. She estimates a required rate of return of 15%. (a)If she expects the company to continue to pay the current $2 dividend indefinitely, what is the maximum she should be willing to pay for a share of Mirage stock? (b)Now suppose she expects the dividend to grow at a constant 4% rate. What is the maximum she should be willing to pay? Suppose that you are offered an investment that is expected to pay you $1000 in 1 year, $3000 in 2 years, $3000 in 3 years, and $5000 in 4 years. Your opportunity cost is 10%. What is the maximum you would be willing to pay for this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts