Question: Please make sure that your Solver model can be viewed. An investment brokerage firm would like to determine how to allocate the funds of a

Please make sure that your Solver model can be viewed.

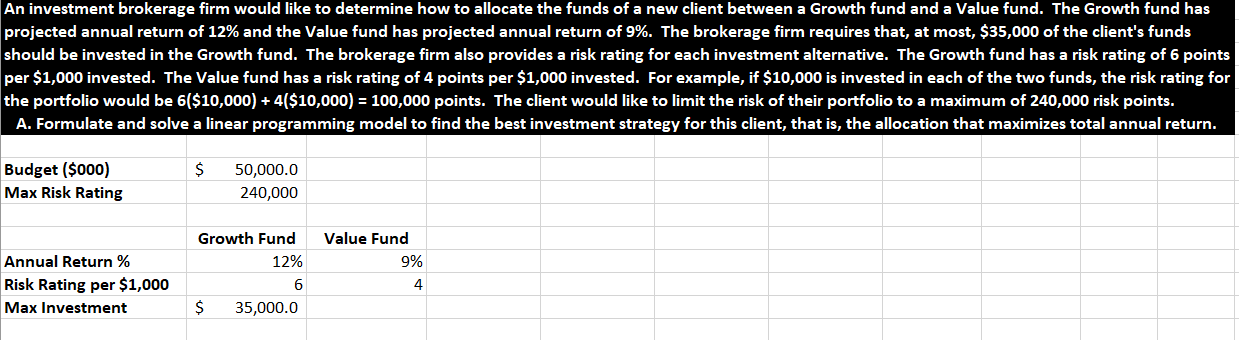

An investment brokerage firm would like to determine how to allocate the funds of a new client between a Growth fund and a Value fund. The Growth fund has projected annual return of 12% and the Value fund has projected annual return of 9%. The brokerage firm requires that, at most, $35,000 of the client's funds should be invested in the Growth fund. The brokerage firm also provides a risk rating for each investment alternative. The Growth fund has a risk rating of 6 points per $1,000 invested. The Value fund has a risk rating of 4 points per $1,000 invested. For example, if $10,000 is invested in each of the two funds, the risk rating for the portfolio would be 6($10,000) + 4($10,000) = 100,000 points. The client would like to limit the risk of their portfolio to a maximum of 240,000 risk points. A. Formulate and solve a linear programming model to find the best investment strategy for this client, that is, the allocation that maximizes total annual return. $ Budget ($000) Max Risk Rating 50,000.0 240,000 Value Fund 9% Annual Return % Risk Rating per $1,000 Max Investment Growth Fund 12% 6 $ 35,000.0 4Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock