Question: Please make sure the answer is correct and explain how you got it, thanks!. Lingenburger Cheese Corporation has 7.4 million shares of common stock outstanding,

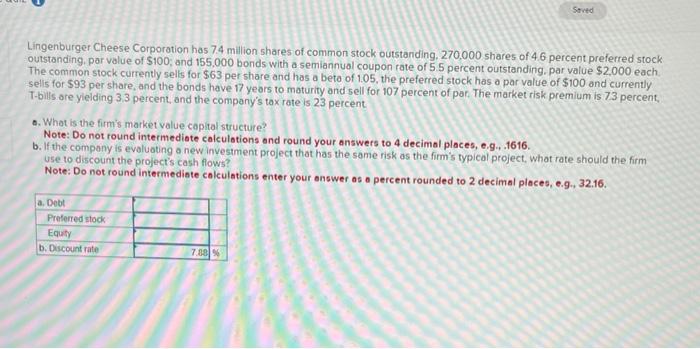

Lingenburger Cheese Corporation has 7.4 million shares of common stock outstanding, 270,000 shares of 4.6 percent preferred stock outstanding. par value of $100; and 155,000 bonds with a semiannual coupon rate of 5.5 percent outstanding. par value $2,000 each The common stock currently sellt for $63 per share and has a beta of 1.05 , the preferred stock has a par value of $100 and currently selis for $93 per share, and the bonds have 17 years to maturity and sell for 107 percent of por. The market risk premium is 73 percent, T-bilts are ylelding 3.3 percent, and the company's tax rate is 23 percent. a. What is the firm's market value capital structure? Note: Do not round intermediate calculations and round your answers to 4 decimal places, e.9. .1616. b. If the company is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows? Note: Do not round intermedinte colculations enter your onswer as a percent rounded to 2 decimal places, e.9., 32.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts