Question: Please make sure the answers are correct and explain how you got them, thanks! Finch, Incorporated, is debating whether or not to convent its all-equity

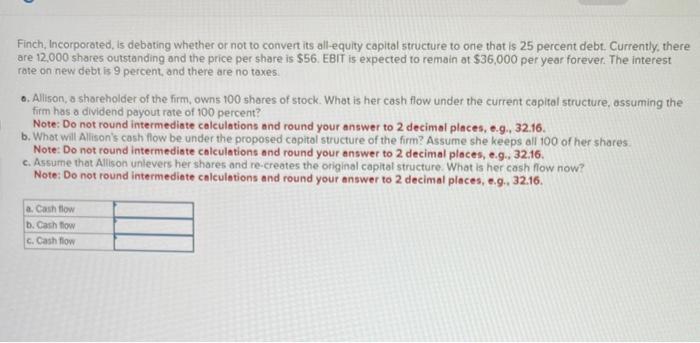

Finch, Incorporated, is debating whether or not to convent its all-equity capital structure to one that is 25 percent debt. Currently, there are 12,000 shares outstanding ond the price per share is $56. EBIT is expected to remain at $36,000 per year forever. The interest rote on new debt is 9 percent, and there are no taxes. 0. Alison, a shareholder of the firm, owns 100 shares of stock. What is her cash flow under the current capital structure, assuming the firm has dividend payout rate of 100 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.9. 32.16. b. Whot will Allison's cash flow be under the proposed copital structure of the firm? Assume she keeps all 100 of her shares Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.9., 32.16. c. Assume that Allison unlevers her shares and re-creates the original capital structure. What is her cash flow now? Note: Do not round intermediate calculotions and round your answer to 2 decimal places, e.9., 32.16. Finch, Incorporated, is debating whether or not to convent its all-equity capital structure to one that is 25 percent debt. Currently, there are 12,000 shares outstanding ond the price per share is $56. EBIT is expected to remain at $36,000 per year forever. The interest rote on new debt is 9 percent, and there are no taxes. 0. Alison, a shareholder of the firm, owns 100 shares of stock. What is her cash flow under the current capital structure, assuming the firm has dividend payout rate of 100 percent? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.9. 32.16. b. Whot will Allison's cash flow be under the proposed copital structure of the firm? Assume she keeps all 100 of her shares Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.9., 32.16. c. Assume that Allison unlevers her shares and re-creates the original capital structure. What is her cash flow now? Note: Do not round intermediate calculotions and round your answer to 2 decimal places, e.9., 32.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts