Question: PLEASE MAKE SURE THE ANSWER IS CORRECT!!!!!! NatNah, a builder of acoustic accessories, has no debt and an equity cost of capital of (

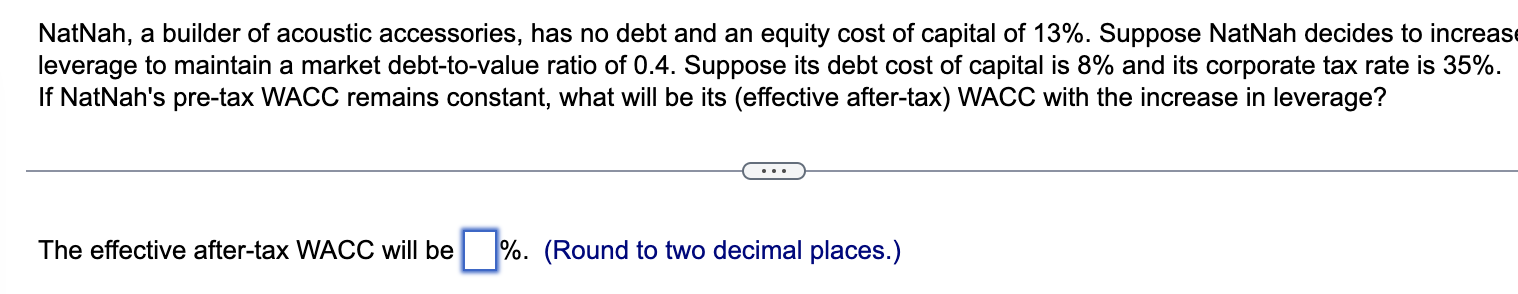

PLEASE MAKE SURE THE ANSWER IS CORRECT!!!!!! NatNah, a builder of acoustic accessories, has no debt and an equity cost of capital of Suppose NatNah decides to increas leverage to maintain a market debttovalue ratio of Suppose its debt cost of capital is and its corporate tax rate is If NatNah's pretax WACC remains constant, what will be its effective aftertax WACC with the increase in leverage?

The effective aftertax WACC will be

Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock