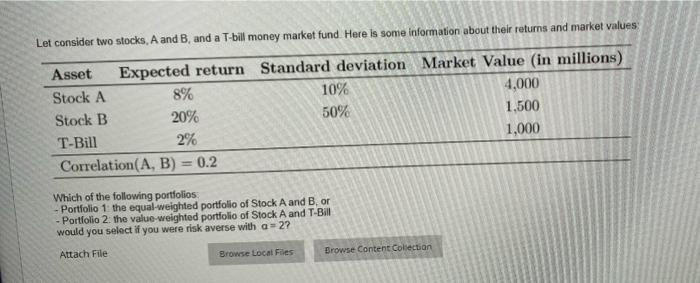

Question: please make sure to show all work. Let consider two stocks, A and B, and a T-bill money market fund Here is some information about

Let consider two stocks, A and B, and a T-bill money market fund Here is some information about their returns and market values 10% Asset Expected return Standard deviation Stock A 8% Stock B 20% 50% T-Bill 2% Correlation(A, B) = 0.2 Market Value (in millions) 4,000 1,500 1,000 Which of the following portfolios - Portfolio 1 the equal weighted portfolio of Stock A and B. or - Portfolio 2 the value-weighted portfolio of Stock A and T-Bill would you select if you were risk averse with a =2? Attach File Browse Local Files Browse Content Collection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts