Question: Please make sure your answer is correct. The CFO of Firm X is trying to determine their WACC and asked your help. According to the

Please make sure your answer is correct.

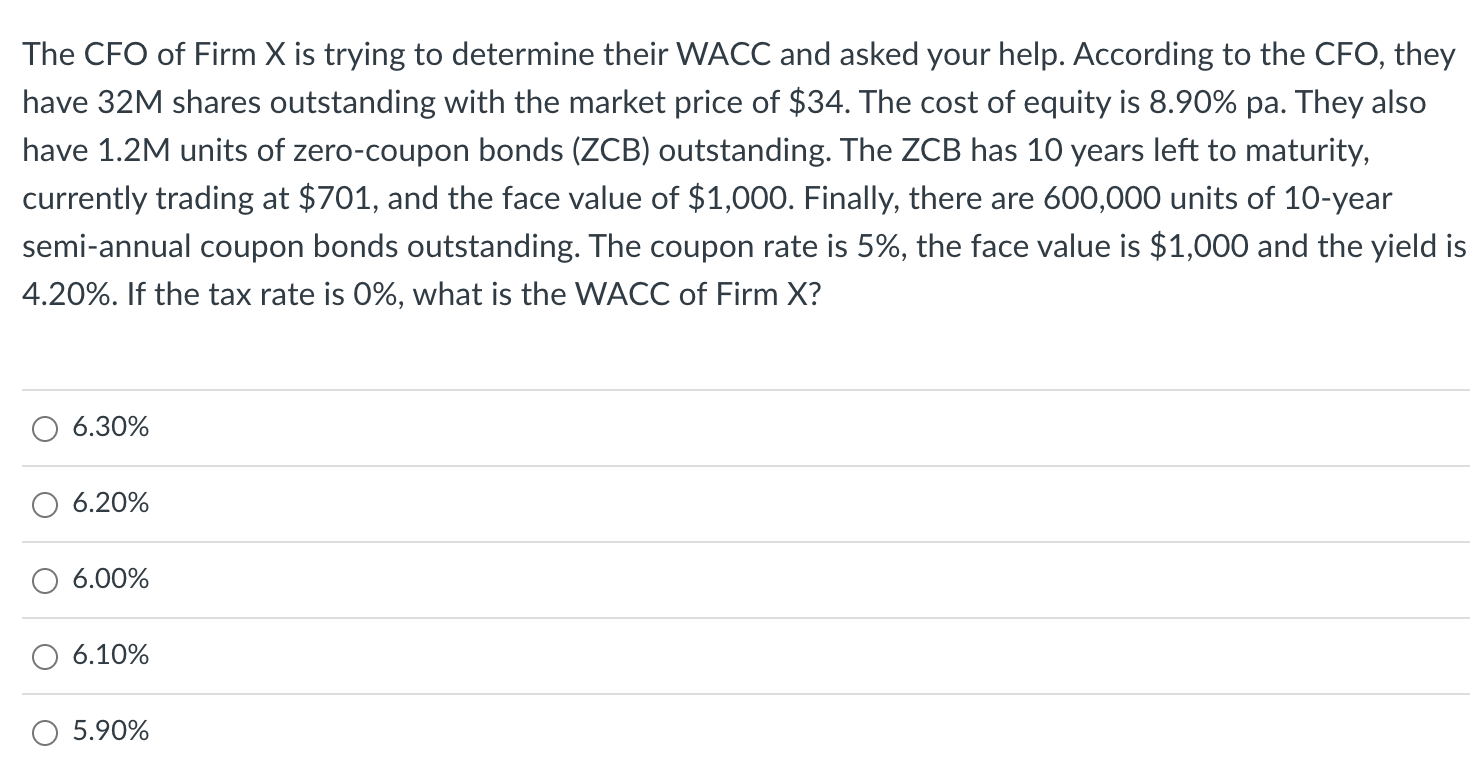

The CFO of Firm X is trying to determine their WACC and asked your help. According to the CFO, they have 32M shares outstanding with the market price of $34. The cost of equity is 8.90% pa. They also have 1.2M units of zero-coupon bonds (ZCB) outstanding. The ZCB has 10 years left to maturity, currently trading at $701, and the face value of $1,000. Finally, there are 600,000 units of 10 -year semi-annual coupon bonds outstanding. The coupon rate is 5%, the face value is $1,000 and the yield is 4.20%. If the tax rate is 0%, what is the WACC of Firm X ? \begin{tabular}{l} \hline 6.30% \\ \hline 6.20% \\ \hline 6.00% \\ \hline 6.10% \\ \hline 5.90% \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts