Question: please mark the correct option as well thanks Blue Jay purchases a life insurance policy with a death benefit of $500,000. The policy pays a

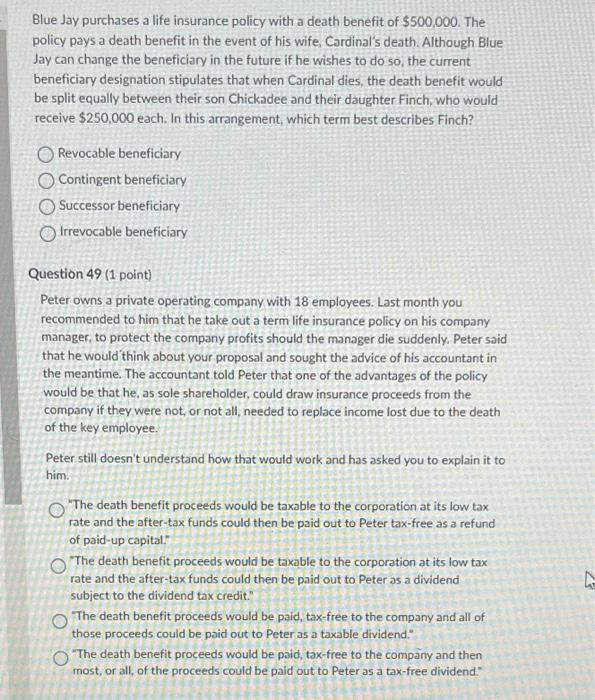

Blue Jay purchases a life insurance policy with a death benefit of $500,000. The policy pays a death benefit in the event of his wife, Cardinal's death. Although Blue Jay can change the beneficiary in the future if he wishes to do so, the current beneficiary designation stipulates that when Cardinal dies, the death benefit would be split equally between their son Chickadee and their daughter Finch, who would receive $250,000 each. In this arrangement, which term best describes Finch? Revocable beneficiary Contingent beneficiary Successor beneficiary Irrevocable beneficiary Question 49 (1 point) Peter owns a private operating company with 18 employees. Last month you recommended to him that he take out a term life insurance policy on his company manager, to protect the company profits should the manager die suddenly. Peter said that he would think about your proposal and sought the advice of his accountant in the meantime. The accountant told Peter that one of the advantages of the policy would be that he, as sole shareholder, could draw insurance proceeds from the company if they were not, or not all, needed to replace income lost due to the death of the key employee. Peter still doesn't understand how that would work and has asked you to explain it to him. "The death benefit proceeds would be taxable to the corporation at its low tax rate and the after-tax funds could then be paid out to Peter tax-free as a refund of paid-up capital." The death benefit proceeds would be taxable to the corporation at its low tax rate and the after-tax funds could then be paid out to Peter as a dividend subject to the dividend tax credit." The death benefit proceeds would be paid, tax-free to the company and all of those proceeds could be poid out to Peter as a taxable dividend." "The death benefit proceeds would be paid, tax-free to the company and then most, or all, of the proceeds could be paid out to Peter as a tax-free dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts