Question: please mark the correct option as well thanks please mark the correct option as well thanks 5t $00, rade out to the insurare cor pary.

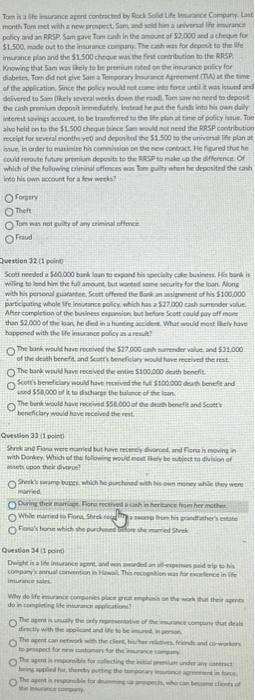

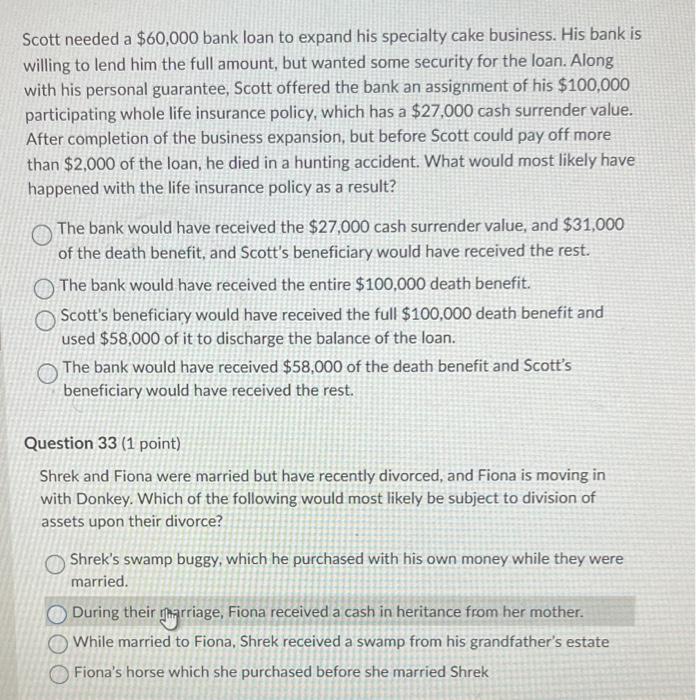

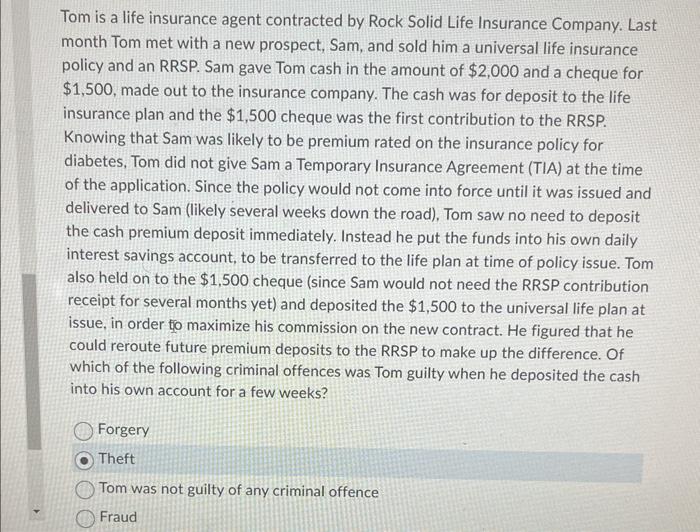

5t $00, rade out to the insurare cor pary. The eah was far depevit ta the if im epance plan and the 51.500 choour wat the fire curtateation to itfe RPSP. of the application. Sence the piler pould net cime ind fore until t wat isaund and deivered to Som inely ieveral werks down the rats. Tart ini ne nest ma depout ines his ewn weecert for a few weris? Forstry Tweit. Fratd Quettien 32 it poine than 52000 of ter ban he ded in a hureing axtedent. What wecid rouf ilefy fure hapeored with the He Iminate policr an a rente? De bark weule have rocelved the 517 ood anh surnder waluct and 5.11,000 of the death behelie and femers bevef etarr woul hure rectived the rest. The hark wirk hav rece ved de entie 5:00,000 derth bencfit: bereficlare mould have incevetd the int. Quensisa 33 it poinei pesets epon their sivene? martice Whice matind ba fant stitaites Question 34 i1 poind iminene uulpt. Scott needed a $60,000 bank loan to expand his specialty cake business. His bank is willing to lend him the full amount, but wanted some security for the loan. Along with his personal guarantee, Scott offered the bank an assignment of his $100,000 participating whole life insurance policy, which has a $27,000 cash surrender value. After completion of the business expansion, but before Scott could pay off more than $2,000 of the loan, he died in a hunting accident. What would most likely have happened with the life insurance policy as a result? The bank would have received the $27,000 cash surrender value, and $31,000 of the death benefit, and Scott's beneficiary would have received the rest. The bank would have received the entire $100,000 death benefit. Scott's beneficiary would have received the full $100,000 death benefit and used $58,000 of it to discharge the balance of the loan. The bank would have received $58,000 of the death benefit and Scott's beneficiary would have received the rest. Question 33 (1 point) Shrek and Fiona were married but have recently divorced, and Fiona is moving in with Donkey. Which of the following would most likely be subject to division of assets upon their divorce? Shrek's swamp buggy, which he purchased with his own money while they were married. During their gttrriage, Fiona received a cash in heritance from her mother. While married to Fiona, Shrek received a swamp from his grandfather's estate Fiona's horse which she purchased before she married Shrek Tom is a life insurance agent contracted by Rock Solid Life Insurance Company. Last month Tom met with a new prospect, Sam, and sold him a universal life insurance policy and an RRSP. Sam gave Tom cash in the amount of $2,000 and a cheque for $1,500, made out to the insurance company. The cash was for deposit to the life insurance plan and the $1,500 cheque was the first contribution to the RRSP. Knowing that Sam was likely to be premium rated on the insurance policy for diabetes, Tom did not give Sam a Temporary Insurance Agreement (TIA) at the time of the application. Since the policy would not come into force until it was issued and delivered to Sam (likely several weeks down the road), Tom saw no need to deposit the cash premium deposit immediately. Instead he put the funds into his own daily interest savings account, to be transferred to the life plan at time of policy issue. Tom also held on to the $1,500 cheque (since Sam would not need the RRSP contribution receipt for several months yet) and deposited the $1,500 to the universal life plan at issue, in order to maximize his commission on the new contract. He figured that he could reroute future premium deposits to the RRSP to make up the difference. Of which of the following criminal offences was Tom guilty when he deposited the cash into his own account for a few weeks? Forgery Theft Tom was not guilty of any criminal offence Fraud 5t $00, rade out to the insurare cor pary. The eah was far depevit ta the if im epance plan and the 51.500 choour wat the fire curtateation to itfe RPSP. of the application. Sence the piler pould net cime ind fore until t wat isaund and deivered to Som inely ieveral werks down the rats. Tart ini ne nest ma depout ines his ewn weecert for a few weris? Forstry Tweit. Fratd Quettien 32 it poine than 52000 of ter ban he ded in a hureing axtedent. What wecid rouf ilefy fure hapeored with the He Iminate policr an a rente? De bark weule have rocelved the 517 ood anh surnder waluct and 5.11,000 of the death behelie and femers bevef etarr woul hure rectived the rest. The hark wirk hav rece ved de entie 5:00,000 derth bencfit: bereficlare mould have incevetd the int. Quensisa 33 it poinei pesets epon their sivene? martice Whice matind ba fant stitaites Question 34 i1 poind iminene uulpt. Scott needed a $60,000 bank loan to expand his specialty cake business. His bank is willing to lend him the full amount, but wanted some security for the loan. Along with his personal guarantee, Scott offered the bank an assignment of his $100,000 participating whole life insurance policy, which has a $27,000 cash surrender value. After completion of the business expansion, but before Scott could pay off more than $2,000 of the loan, he died in a hunting accident. What would most likely have happened with the life insurance policy as a result? The bank would have received the $27,000 cash surrender value, and $31,000 of the death benefit, and Scott's beneficiary would have received the rest. The bank would have received the entire $100,000 death benefit. Scott's beneficiary would have received the full $100,000 death benefit and used $58,000 of it to discharge the balance of the loan. The bank would have received $58,000 of the death benefit and Scott's beneficiary would have received the rest. Question 33 (1 point) Shrek and Fiona were married but have recently divorced, and Fiona is moving in with Donkey. Which of the following would most likely be subject to division of assets upon their divorce? Shrek's swamp buggy, which he purchased with his own money while they were married. During their gttrriage, Fiona received a cash in heritance from her mother. While married to Fiona, Shrek received a swamp from his grandfather's estate Fiona's horse which she purchased before she married Shrek Tom is a life insurance agent contracted by Rock Solid Life Insurance Company. Last month Tom met with a new prospect, Sam, and sold him a universal life insurance policy and an RRSP. Sam gave Tom cash in the amount of $2,000 and a cheque for $1,500, made out to the insurance company. The cash was for deposit to the life insurance plan and the $1,500 cheque was the first contribution to the RRSP. Knowing that Sam was likely to be premium rated on the insurance policy for diabetes, Tom did not give Sam a Temporary Insurance Agreement (TIA) at the time of the application. Since the policy would not come into force until it was issued and delivered to Sam (likely several weeks down the road), Tom saw no need to deposit the cash premium deposit immediately. Instead he put the funds into his own daily interest savings account, to be transferred to the life plan at time of policy issue. Tom also held on to the $1,500 cheque (since Sam would not need the RRSP contribution receipt for several months yet) and deposited the $1,500 to the universal life plan at issue, in order to maximize his commission on the new contract. He figured that he could reroute future premium deposits to the RRSP to make up the difference. Of which of the following criminal offences was Tom guilty when he deposited the cash into his own account for a few weeks? Forgery Theft Tom was not guilty of any criminal offence Fraud

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts