Question: Please mark the only INCORRECT statement about FX and Hard Currency Debt trading in Latin American markets a. Relative value trades are built on the

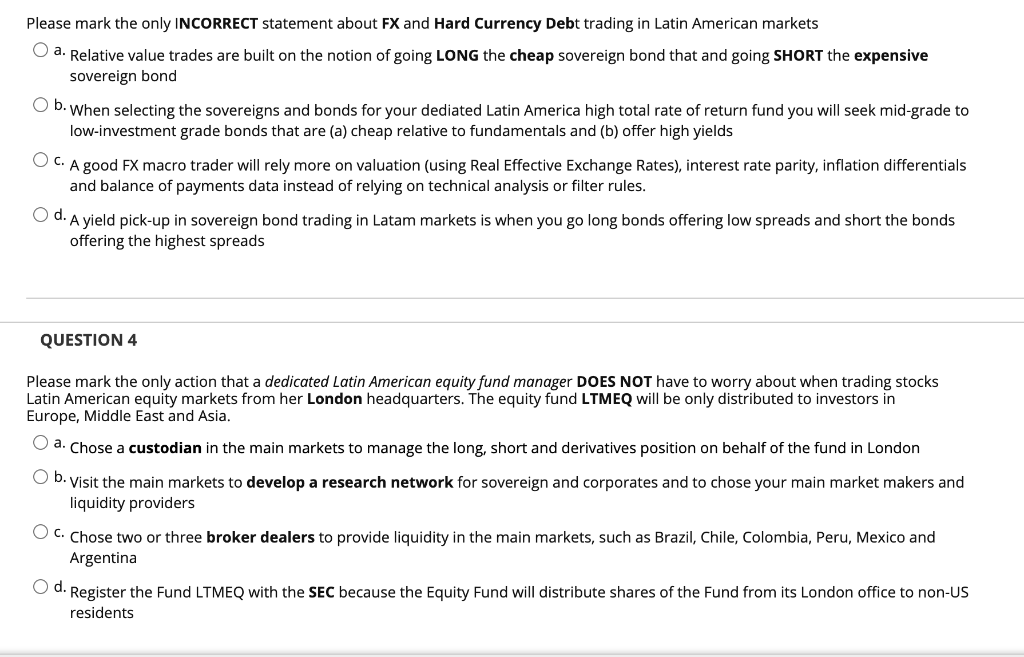

Please mark the only INCORRECT statement about FX and Hard Currency Debt trading in Latin American markets a. Relative value trades are built on the notion of going LONG the cheap sovereign bond that and going SHORT the expensive sovereign bond b. When selecting the sovereigns and bonds for your dediated Latin America high total rate of return fund you will seek mid-grade to low-investment grade bonds that are (a) cheap relative to fundamentals and (b) offer high yields OC. A good FX macro trader will rely more on valuation (using Real Effective Exchange Rates), interest rate parity, inflation differentials and balance of payments data instead of relying on technical analysis or filter rules. O d. A yield pick-up in sovereign bond trading in Latam markets is when you go long bonds offering low spreads and short the bonds offering the highest spreads QUESTION 4 Please mark the only action that a dedicated Latin American equity fund manager DOES NOT have to worry about when trading stocks Latin American equity markets from her London headquarters. The equity fund LTMEQ will be only distributed to investors in Europe, Middle East and Asia. a. Chose a custodian in the main markets to manage the long, short and derivatives position on behalf of the fund in London b. Visit the main markets to develop a research network for sovereign and corporates and to chose your main market makers and liquidity providers OC. Chose two or three broker dealers to provide liquidity in the main markets, such as Brazil, Chile, Colombia, Peru, Mexico and Argentina d. Register the Fund LTMEQ with the SEC because the Equity Fund will distribute shares of the Fund from its London office to non-us residents Please mark the only INCORRECT statement about FX and Hard Currency Debt trading in Latin American markets a. Relative value trades are built on the notion of going LONG the cheap sovereign bond that and going SHORT the expensive sovereign bond b. When selecting the sovereigns and bonds for your dediated Latin America high total rate of return fund you will seek mid-grade to low-investment grade bonds that are (a) cheap relative to fundamentals and (b) offer high yields OC. A good FX macro trader will rely more on valuation (using Real Effective Exchange Rates), interest rate parity, inflation differentials and balance of payments data instead of relying on technical analysis or filter rules. O d. A yield pick-up in sovereign bond trading in Latam markets is when you go long bonds offering low spreads and short the bonds offering the highest spreads QUESTION 4 Please mark the only action that a dedicated Latin American equity fund manager DOES NOT have to worry about when trading stocks Latin American equity markets from her London headquarters. The equity fund LTMEQ will be only distributed to investors in Europe, Middle East and Asia. a. Chose a custodian in the main markets to manage the long, short and derivatives position on behalf of the fund in London b. Visit the main markets to develop a research network for sovereign and corporates and to chose your main market makers and liquidity providers OC. Chose two or three broker dealers to provide liquidity in the main markets, such as Brazil, Chile, Colombia, Peru, Mexico and Argentina d. Register the Fund LTMEQ with the SEC because the Equity Fund will distribute shares of the Fund from its London office to non-us residents

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts