Question: please move this answers to answer sheet please use the terms and figure have given here is questions module mortgages this the answres i received

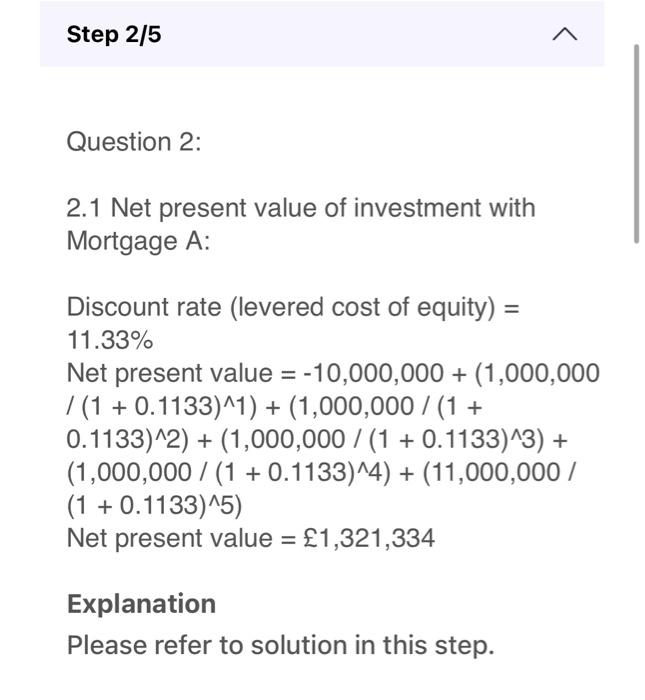

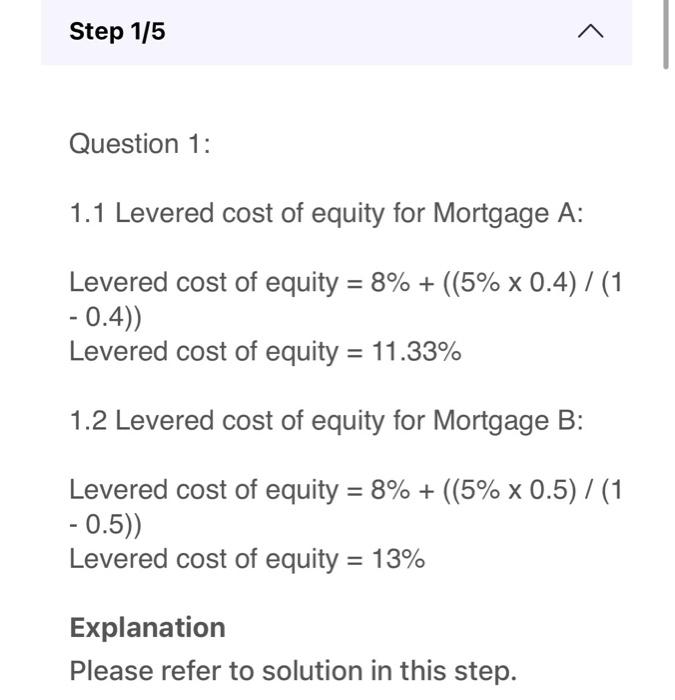

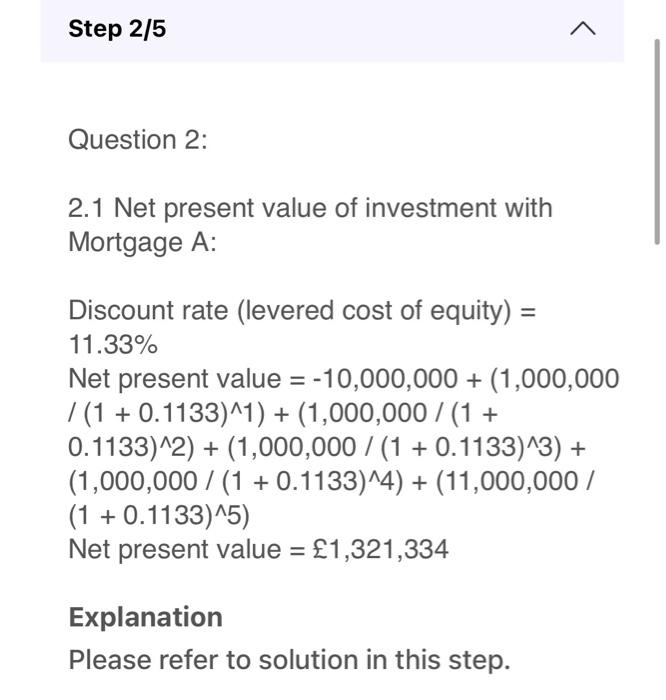

Yos me inlerested in investing in a bulding cossing fio, 000.000 Vou cah either linanoe Mat punghase of the bulding uting either: > Morloage A and a 40% loan-bo-value rabig, of > Morloage B and a ENN loan-13-yalue ratio Further dotals regaving the morlgages are provided in Tablie 1. You reaure an the retum on an undevared equity imetimant. You astigate teceiving C1,000.000 in rental income at the end ct every yar for fie yeari. Vou plin bs aell the bulling afar five yeari der fit,000.000. Thatile 3: Mortouge denuti Question 1 Question 2: 2.1 Net present value of investment with Mortgage A: Discount rate (levered cost of equity) = 11.33% Net present value =10,000,000+(1,000,000 /(1+0.1133)1)+(1,000,000/(1+ 0.1133)2)+(1,000,000/(1+0.1133)3)+ (1,000,000/(1+0.1133)4)+(11,000,000/ (1+0.1133)5) Net present value =1,321,334 Explanation Please refer to solution in this step. Question 1: 1.1 Levered cost of equity for Mortgage A: Levered cost of equity =8%+((5%0.4)/(1 0.4)) Levered cost of equity =11.33% 1.2 Levered cost of equity for Mortgage B: Levered cost of equity =8%+((5%0.5)/(1 0.5)) Levered cost of equity =13% Explanation Please refer to solution in this step. Question 2: 2.1 Net present value of investment with Mortgage A: Discount rate (levered cost of equity) = 11.33% Net present value =10,000,000+(1,000,000 /(1+0.1133)1)+(1,000,000/(1+ 0.1133)2)+(1,000,000/(1+0.1133)3)+ (1,000,000/(1+0.1133)4)+(11,000,000/ (1+0.1133)5) Net present value =1,321,334 Explanation Please refer to solution in this step. 2.4 The advantage of opting for Mortgage A would be a lower loan-to-value ratio of 40% compared to Mortgage B's 50\%. This means that with Mortgage A, there is less debt to be repaid, which leads to a lower financial risk. Additionally, Mortgage A has a lower levered cost of equity, which leads to a higher net present value of the investment. Therefore, Mortgage A provides a better value for the investment in terms of risk and return. Explanation Please refer to solution in this step. Answers only I hope it's helpful to you , Please like, Thanks in advance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts