Question: please nd answer now 16 The historical data shows that the following class of securities had the least risk (measured by the standard deviation of

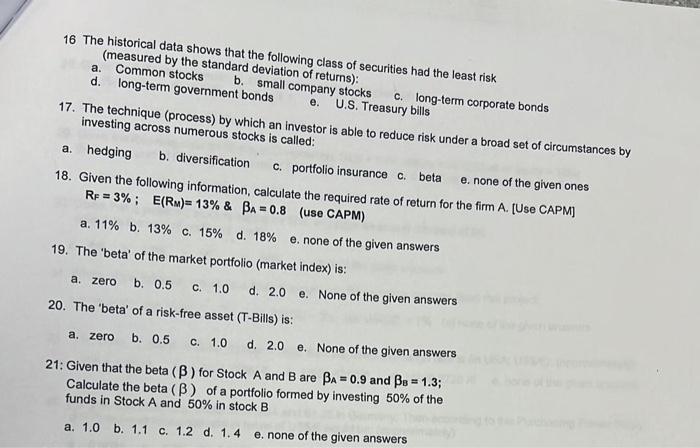

16 The historical data shows that the following class of securities had the least risk (measured by the standard deviation of returns): a.Commonstocksb.smallcompanystocksc.long-termcorporatebonds 17. The technique (process) by which investing across numerous stocks in investor is able to reduce risk under a broad set of circumstances by a. hedging b. diversification 18. Given the following information, calculate the required rate of return for the firm A. [Use CAPM] RF=3%;E(RM)=13% \& A=0.8 (use CAPM) a. 11% b. 13% c. 15% d. 18% e. none of the given answers 19. The 'beta' of the market portfolio (market index) is: a. zero b. 0.5 c. 1.0 d. 2.0 e. None of the given answers 20. The 'beta' of a risk-free asset (T-Bills) is: a. zero b. 0.5 c. 1.0 d. 2.0 e. None of the given answers 21: Given that the beta () for Stock A and B are A=0.9 and B=1.3; Calculate the beta () of a portfolio formed by investing 50% of the funds in Stock A and 50% in stock B a. 1.0 b. 1.1 c. 1.2 d. 1,4 e. none of the given answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts