Question: please need correct answer for all 4 requirements pls post answer full seen view i will upvote it pls post in visible view thanks Problem

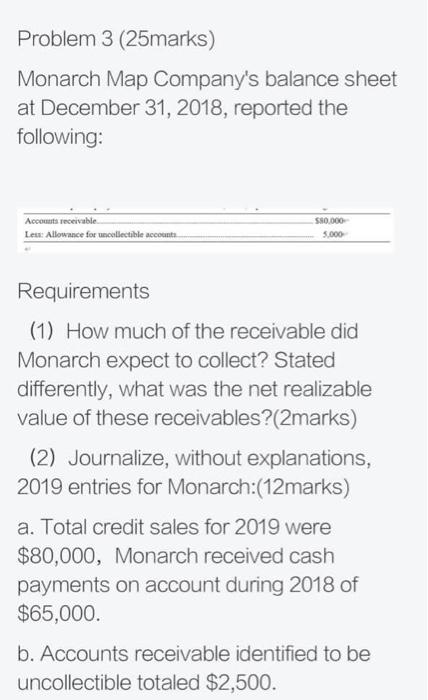

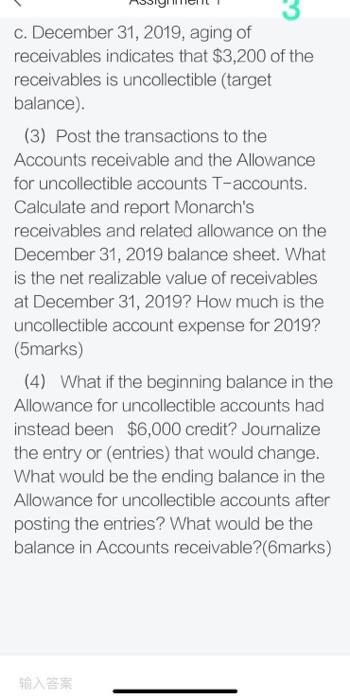

Problem 3 (25marks) Monarch Map Company's balance sheet at December 31, 2018, reported the following: Accounts receivable Leia: Allowance for uncollectible accounts S80.000 5.000 Requirements (1) How much of the receivable did Monarch expect to collect? Stated differently, what was the net realizable value of these receivables? (2marks) (2) Journalize, without explanations, 2019 entries for Monarch:(12marks) a. Total credit sales for 2019 were $80,000, Monarch received cash payments on account during 2018 of $65,000. b. Accounts receivable identified to be uncollectible totaled $2,500. c. December 31, 2019, aging of receivables indicates that $3,200 of the receivables is uncollectible (target balance) (3) Post the transactions to the Accounts receivable and the Allowance for uncollectible accounts T-accounts. Calculate and report Monarch's receivables and related allowance on the December 31, 2019 balance sheet. What is the net realizable value of receivables at December 31, 2019? How much is the uncollectible account expense for 2019? (5marks) (4) What if the beginning balance in the Allowance for uncollectible accounts had instead been $6,000 credit? Journalize the entry or (entries) that would change. What would be the ending balance in the Allowance for uncollectible accounts after posting the entries? What would be the balance in Accounts receivable? (marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts