Question: please need correct answer for requirement 2,3,4 pls i will upvote your answer thank you Answer the Following Questions Based on the Information Given in

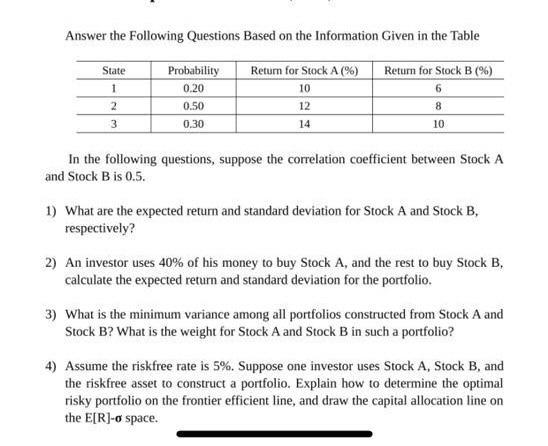

Answer the Following Questions Based on the Information Given in the Table State 1 2 Probability 0.20 0.50 0.30 Return for Stock A (%) 10 12 14 Return for Stock B (%) 6 8 3 10 In the following questions, suppose the correlation coefficient between Stock A and Stock B is 0.5. 1) What are the expected return and standard deviation for Stock A and Stock B, respectively? 2) An investor uses 40% of his money to buy Stock A, and the rest to buy Stock B, calculate the expected return and standard deviation for the portfolio. 3) What is the minimum variance among all portfolios constructed from Stock A and Stock B? What is the weight for Stock A and Stock B in such a portfolio? 4) Assume the riskfree rate is 5%. Suppose one investor uses Stock A, Stock B, and the riskfree asset to construct a portfolio. Explain how to determine the optimal risky portfolio on the frontier efficient line, and draw the capital allocation line on the E[R]-o space

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts