Question: PLEASE NEED TO EXPLAIN EACH POINTTHE IDEA TO RESEARCH AND DISCOVER UN INSURANCE TO BE INSURANCE AND EXPLAIN EACH POINT FROM 1 TO 6 like

PLEASE NEED TO EXPLAIN EACH POINTTHE IDEA TO RESEARCH AND DISCOVER UN INSURANCE TO BE INSURANCE AND EXPLAIN EACH POINT FROM 1 TO 6 like

1-We chose to ensure outdoor events first point: a large number of exposure units:

Wedding day it's a momentous day for the bride, groom, and their families, as much as to For a wedding event planner, this day is their time to shine. So

There are a lot of Weddings planers who want to cover their losses in case anything unexpected happens with the weather. And with the winter period, any mishaps, mistakes, or accidents are likely to occur.

For example, in the winter period, there are many weather fluctuations, and there are many wedding planners who are worried about the weather and weather fluctuations.

So I think Yes, there are a lot of Weddings planers who want to cover their losses if anything unexpected happens from the weather. 2-It will be an accidental loss because it usually will be a natural condition such as the weather like rain and dust. We will not be worried about theft because Bahrain is a safe country, so that will not be a concern for our customers. also, since it there wading, they will not ruin their day 3-Yes, it can be measurable. Since they are tangible things, we can estimate the loss according to the price of tables, chairs, flowers, and other items added. Natural accidents in Bahrain are simple in that they are limited to the weather and are often easy to measure. 4- No catastrophic loss: Yes, no catastrophic failure because not every event will get damaged simultaneously. For example, marriage Event A was destroyed because of high electricity voltage in the lights. And marriage Event B will not face the same marriage event A problem. 5- calculable chance of loss: Yes, the case of event damage can be calculated, and the average of the severity of electricity or fire can be estimated. For example, fire damage will insure with BD1000 for any chance fire or electricity damage we will insure by BD1000, and we can calculate the severity of fire damage in advance. 6- Economically feasible premium: Yes, the premium rate of fire or electricity damage is 10%, including free event planning and free food and cake, so 10% is affordable for everyone, and the insurance is relatively low and affordable.

You choose the wedding or animals the insurance, not Insure the wedding or the animal and explain it on the tables like a large number of exposure units the second accidental and unintentional loss till number 6.

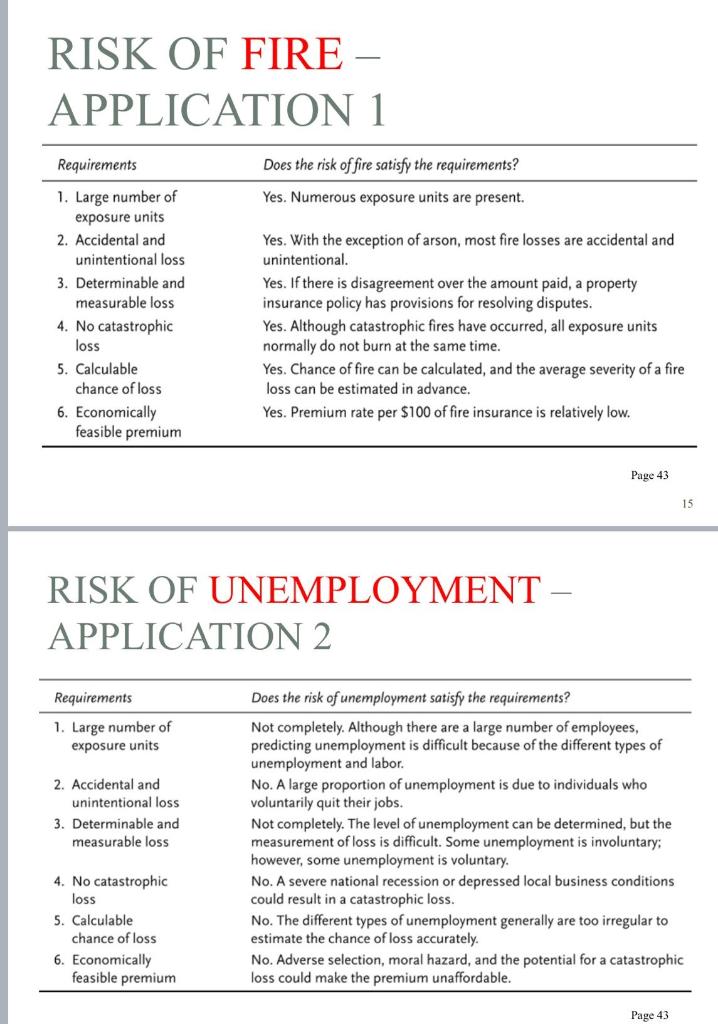

RISK OF FIRE APPLICATION 1 Requirements Does the risk of fire satisfy the requirements? Yes. Numerous exposure units are present. 1. Large number of exposure units 2. Accidental and unintentional loss 3. Determinable and measurable loss 4. No catastrophic loss 5. Calculable chance of loss 6. Economically feasible premium Yes. With the exception of arson, most fire losses are accidental and unintentional. Yes. If there is disagreement over the amount paid, a property insurance policy has provisions for resolving disputes. Yes. Although catastrophic fires have occurred, all exposure units normally do not burn at the same time. Yes. Chance of fire can be calculated, and the average severity of a fire loss can be estimated in advance. Yes. Premium rate per $100 of fire insurance is relatively low. Page 43 15 RISK OF UNEMPLOYMENT APPLICATION 2 Requirements 1. Large number of exposure units 2. Accidental and unintentional loss 3. Determinable and measurable loss Does the risk of unemployment satisfy the requirements? Not completely. Although there are a large number of employees, predicting unemployment is difficult because of the different types of unemployment and labor. No. A large proportion of unemployment is due to individuals who voluntarily quit their jobs. Not completely. The level of unemployment can be determined, but the measurement of loss is difficult. Some unemployment is involuntary: however, some unemployment is voluntary. No. A severe national recession or depressed local business conditions could result in a catastrophic loss. No. The different types of unemployment generally are too irregular to estimate the chance of loss accurately. No. Adverse selection, moral hazard, and the potential for a catastrophic loss could make the premium unaffordable. 4. No catastrophic loss 5. Calculable chance of loss 6. Economically feasible premium Page 43 RISK OF FIRE APPLICATION 1 Requirements Does the risk of fire satisfy the requirements? Yes. Numerous exposure units are present. 1. Large number of exposure units 2. Accidental and unintentional loss 3. Determinable and measurable loss 4. No catastrophic loss 5. Calculable chance of loss 6. Economically feasible premium Yes. With the exception of arson, most fire losses are accidental and unintentional. Yes. If there is disagreement over the amount paid, a property insurance policy has provisions for resolving disputes. Yes. Although catastrophic fires have occurred, all exposure units normally do not burn at the same time. Yes. Chance of fire can be calculated, and the average severity of a fire loss can be estimated in advance. Yes. Premium rate per $100 of fire insurance is relatively low. Page 43 15 RISK OF UNEMPLOYMENT APPLICATION 2 Requirements 1. Large number of exposure units 2. Accidental and unintentional loss 3. Determinable and measurable loss Does the risk of unemployment satisfy the requirements? Not completely. Although there are a large number of employees, predicting unemployment is difficult because of the different types of unemployment and labor. No. A large proportion of unemployment is due to individuals who voluntarily quit their jobs. Not completely. The level of unemployment can be determined, but the measurement of loss is difficult. Some unemployment is involuntary: however, some unemployment is voluntary. No. A severe national recession or depressed local business conditions could result in a catastrophic loss. No. The different types of unemployment generally are too irregular to estimate the chance of loss accurately. No. Adverse selection, moral hazard, and the potential for a catastrophic loss could make the premium unaffordable. 4. No catastrophic loss 5. Calculable chance of loss 6. Economically feasible premium Page 43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts