Question: please, new solution don't copy and paste On January 1, 2009 Kimura Corporation sold a machine having an original cost of $70,000 and a book

please, new solution don't copy and paste

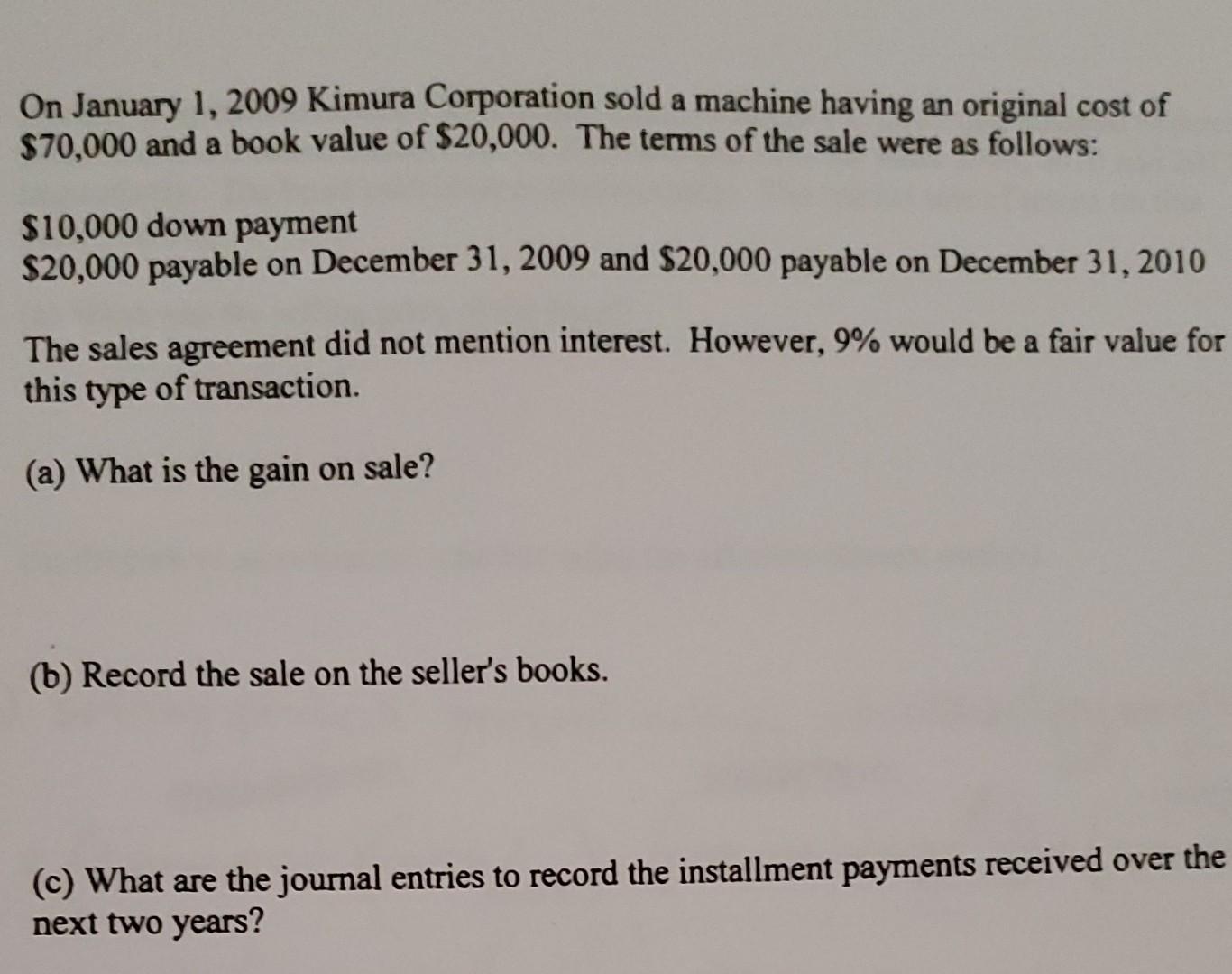

On January 1, 2009 Kimura Corporation sold a machine having an original cost of $70,000 and a book value of $20,000. The terms of the sale were as follows: $10,000 down payment $20,000 payable on December 31, 2009 and $20,000 payable on December 31, 2010 a The sales agreement did not mention interest. However, 9% would be a fair value for this type of transaction. (a) What is the gain on sale? (6) Record the sale on the seller's books. (c) What are the journal entries to record the installment payments received over the next two years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts