Question: Please no ChatGPT copy and paste, much appreciated :) !!! Journalise equipment transactions related to purchase, sale, scrapping and depreciation. L02,4,8,14 At 30 June 2022,

Please no ChatGPT copy and paste, much appreciated :) !!!

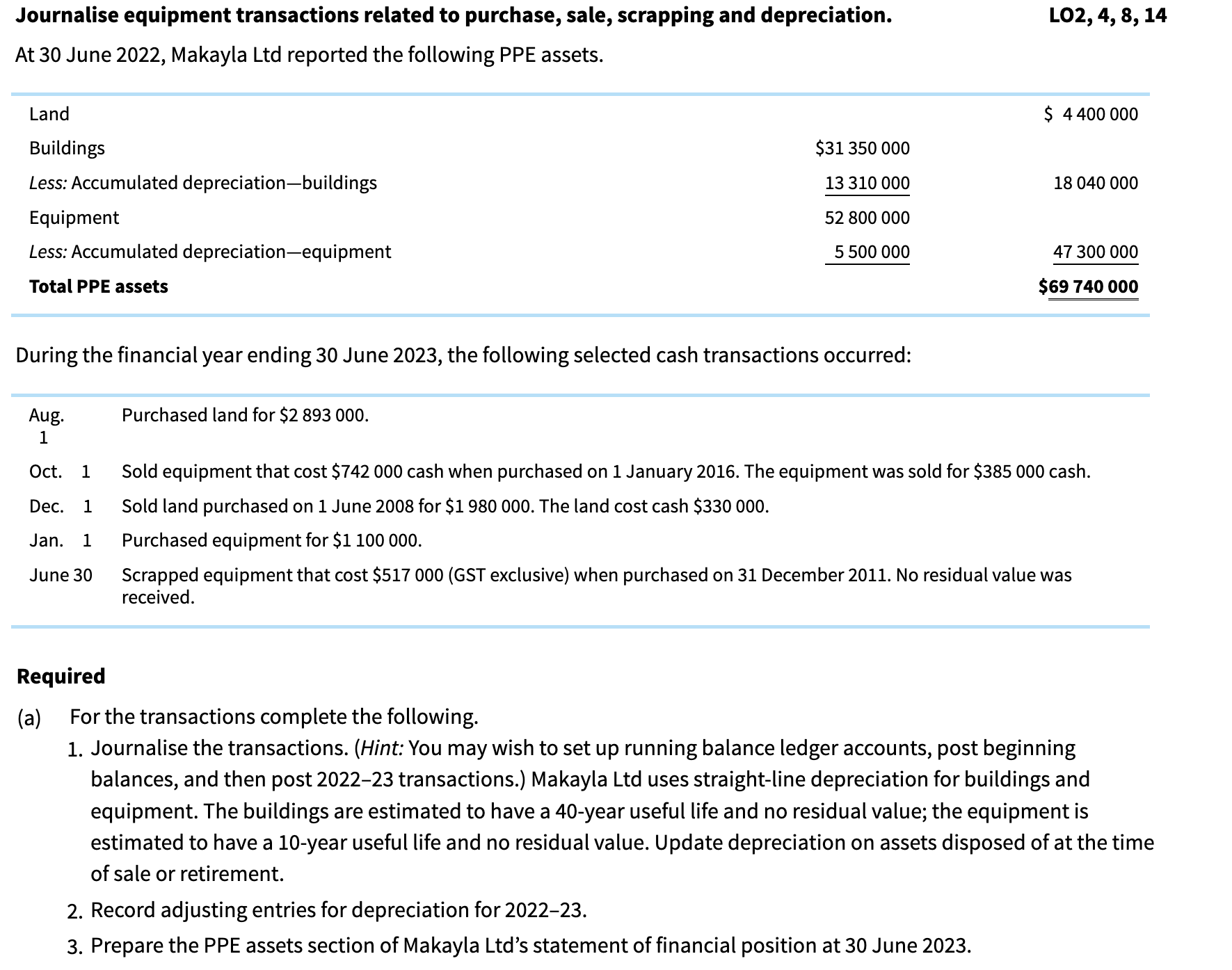

Journalise equipment transactions related to purchase, sale, scrapping and depreciation. L02,4,8,14 At 30 June 2022, Makayla Ltd reported the following PPE assets. Required (a) For the transactions complete the following. 1. Journalise the transactions. (Hint: You may wish to set up running balance ledger accounts, post beginning balances, and then post 2022-23 transactions.) Makayla Ltd uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no residual value; the equipment is estimated to have a 10-year useful life and no residual value. Update depreciation on assets disposed of at the time of sale or retirement. 2. Record adjusting entries for depreciation for 2022-23. 3. Prepare the PPE assets section of Makayla Ltd's statement of financial position at 30 June 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts