Question: please no excel and show the math (4) (30 points) Consider the following two bonds. Bond 1 has face value F-820000 and zero coupons, maturity

please no excel and show the math

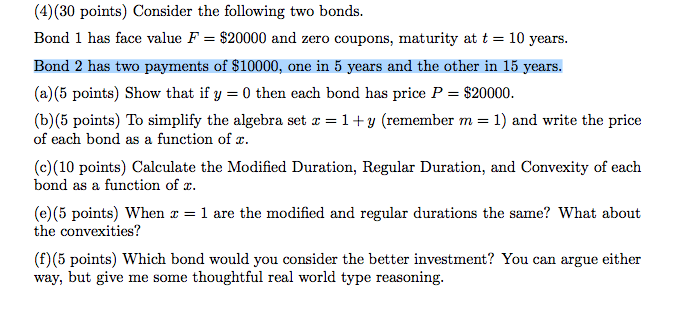

(4) (30 points) Consider the following two bonds. Bond 1 has face value F-820000 and zero coupons, maturity at t 10 years. Bond 2 has two payments of $10000, one in 5 years and the other in 15 years. (a)(5 points) Show that if y = 0 then each bond has price P = $20000. (b) (5 points) To simplify the algebra set z 1 + y (remember m = 1) and write the price of each bond as a function of x (c) (10 points) Calculate the Modified Duration, Regular Duration, and Convexity of each bond as a function of r (e)(5 points) when z = 1 are the modified and regular durations the same? What about the convexities? (f) (5 points) Which bond would you consider the better investment? You can argue either way, but give me some thoughtful real world type reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts