Question: PLEASE NO NEED FOR ANY EXPLANATIONS . PLEASE ONLY NEED THE ANSWER 4) $.00694 A between a bank and a customer calls for a fixed

PLEASE NO NEED FOR ANY EXPLANATIONS. PLEASE ONLY NEED THE ANSWER

4) $.00694

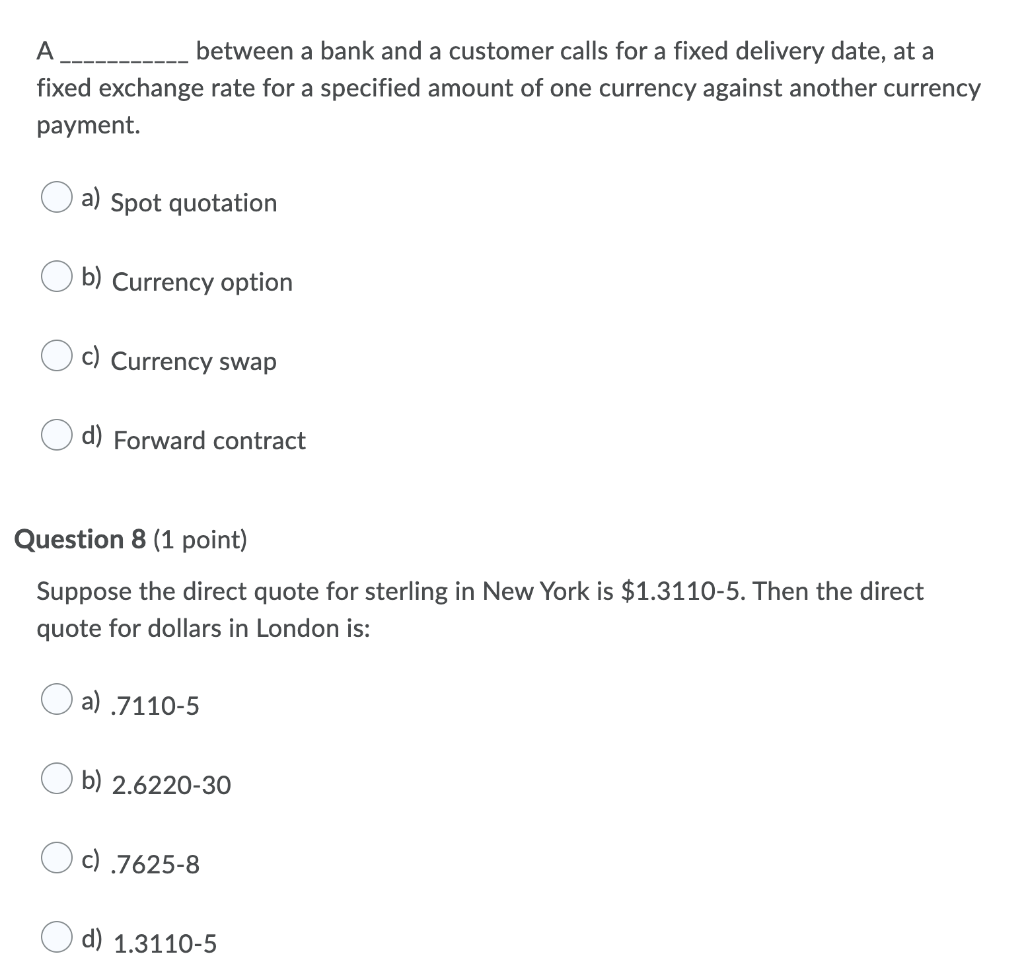

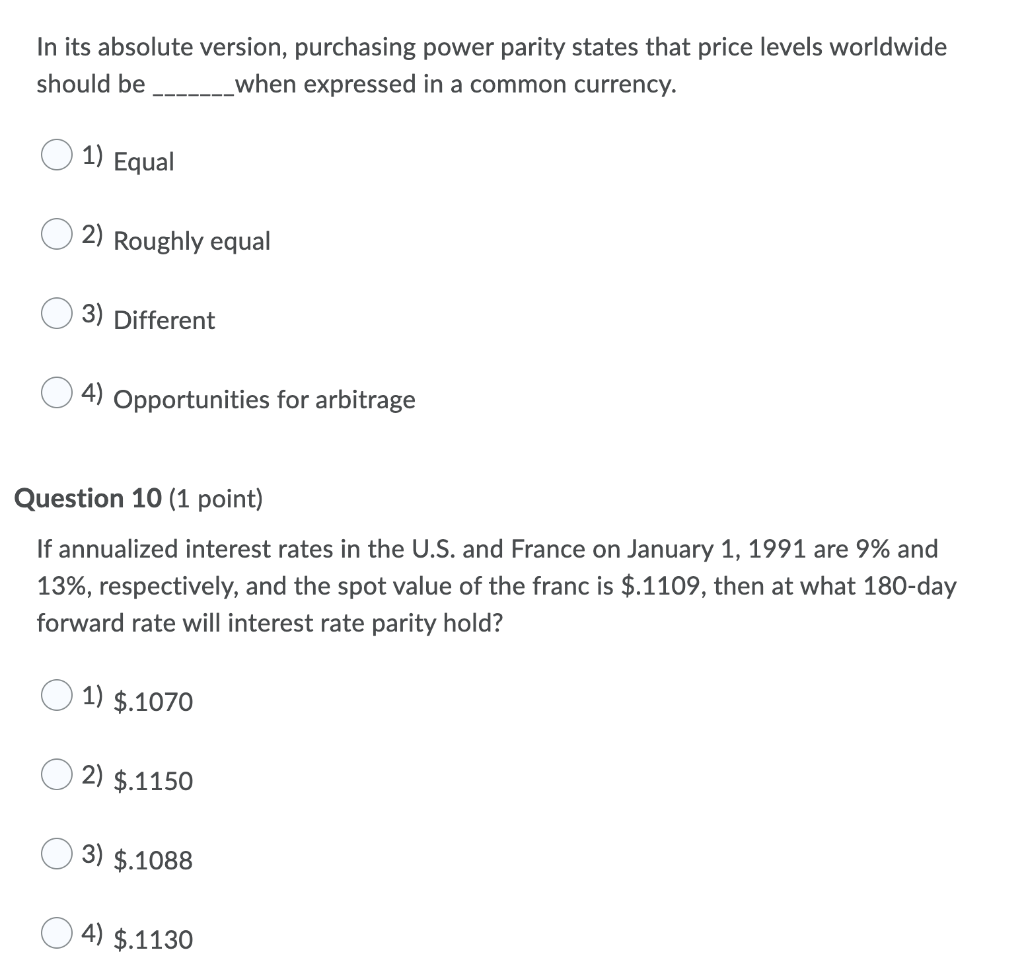

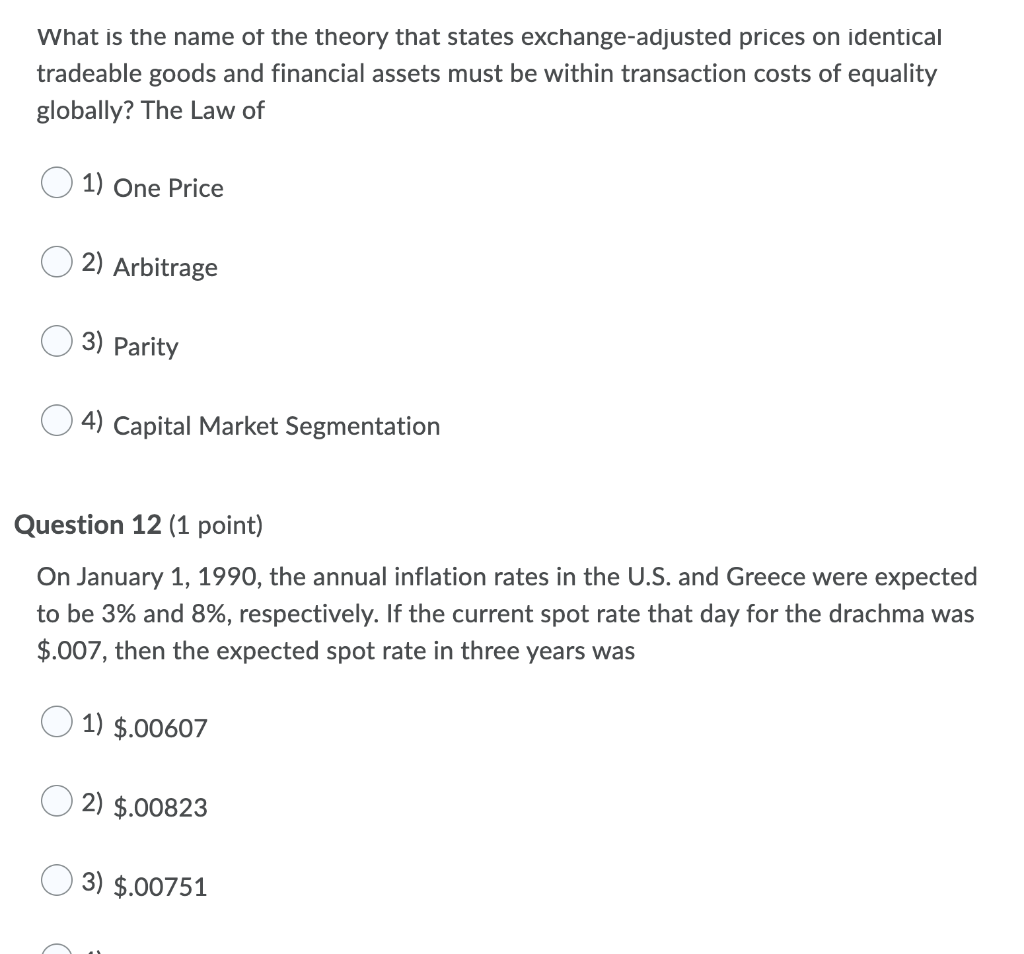

A between a bank and a customer calls for a fixed delivery date, at a fixed exchange rate for a specified amount of one currency against another currency payment. a) Spot quotation b) Currency option c) Currency swap d) Forward contract Question 8 (1 point) Suppose the direct quote for sterling in New York is $1.3110-5. Then the direct quote for dollars in London is: a) 7110-5 b) 2.6220-30 O c) .7625-8 d) 1.3110-5 In its absolute version, purchasing power parity states that price levels worldwide should be _____when expressed in a common currency. 1) Equal 2) Roughly equal 3) Different 4) Opportunities for arbitrage Question 10 (1 point) If annualized interest rates in the U.S. and France on January 1, 1991 are 9% and 13%, respectively, and the spot value of the franc is $.1109, then at what 180-day forward rate will interest rate parity hold? 1) $.1070 2) $.1150 3) $.1088 4) $.1130 What is the name of the theory that states exchange-adjusted prices on identical tradeable goods and financial assets must be within transaction costs of equality globally? The Law of 1) One Price 2) Arbitrage 3) Parity 4) Capital Market Segmentation Question 12 (1 point) On January 1, 1990, the annual inflation rates in the U.S. and Greece were expected to be 3% and 8%, respectively. If the current spot rate that day for the drachma was $.007, then the expected spot rate in three years was 1) $.00607 2) $.00823 3) $.00751

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts