Question: please not write by hand 1. The beer industry consists of firms with the following revenue shares per year: . Anheuser-Busch/Inbev (Budweiser and so on):

please not write by hand

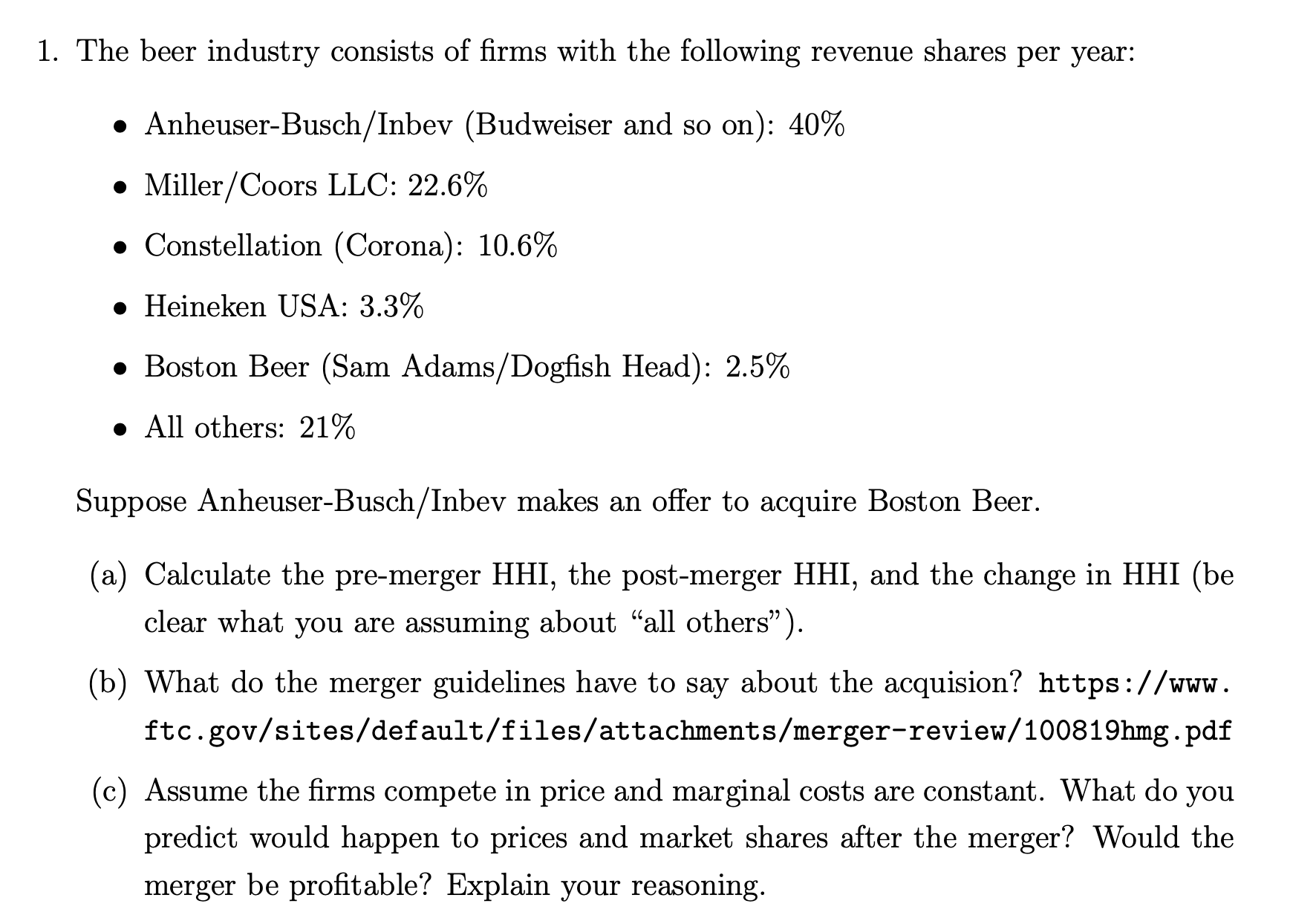

1. The beer industry consists of firms with the following revenue shares per year: . Anheuser-Busch/Inbev (Budweiser and so on): 40% . Miller / Coors LLC: 22.6% . Constellation (Corona): 10.6% . Heineken USA: 3.3% . Boston Beer (Sam Adams/Dogfish Head): 2.5% . All others: 21% Suppose Anheuser-Busch/Inbev makes an offer to acquire Boston Beer. (a) Calculate the pre-merger HHI, the post-merger HHI, and the change in HHI (be clear what you are assuming about "all others" ). (b) What do the merger guidelines have to say about the acquision? https ://www. ftc. gov/sites/default/files/attachments/merger-review/100819hmg. pdf (c) Assume the firms compete in price and marginal costs are constant. What do you predict would happen to prices and market shares after the merger? Would the merger be profitable? Explain your reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts