Question: PLEASE NOTE I HAVE POSTED THIS QUESTION BEFORE. PLEASE HELP WITH TE POSTED SECTION. b) It would be more realistic to take into account the

PLEASE NOTE I HAVE POSTED THIS QUESTION BEFORE. PLEASE HELP WITH TE POSTED SECTION.

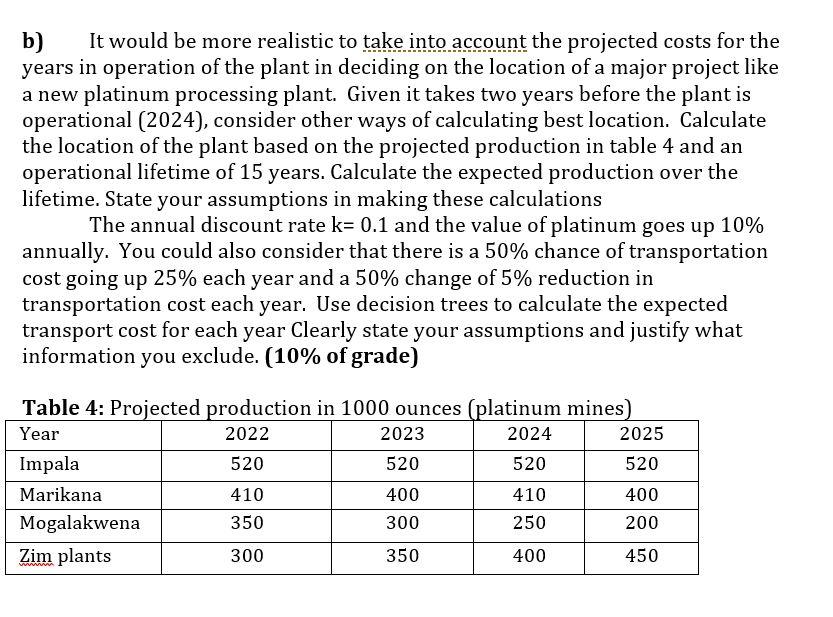

b) It would be more realistic to take into account the projected costs for the years in operation of the plant in deciding on the location of a major project like a new platinum processing plant. Given it takes two years before the plant is operational (2024), consider other ways of calculating best location. Calculate the location of the plant based on the projected production in table 4 and an operational lifetime of 15 years. Calculate the expected production over the lifetime. State your assumptions in making these calculations The annual discount rate k=0.1 and the value of platinum goes up 10% annually. You could also consider that there is a 50% chance of transportation cost going up 25% each year and a 50% change of 5% reduction in transportation cost each year. Use decision trees to calculate the expected transport cost for each year Clearly state your assumptions and justify what information you exclude. (10% of grade )Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock