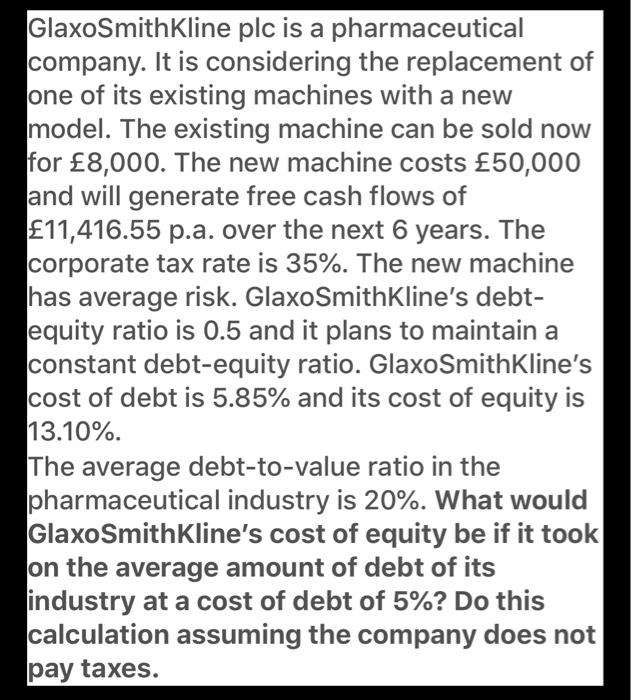

Question: Please note - question says DEBT TO VALUE!!!!! GlaxoSmithKline plc is a pharmaceutical company. It is considering the replacement of one of its existing machines

GlaxoSmithKline plc is a pharmaceutical company. It is considering the replacement of one of its existing machines with a new model. The existing machine can be sold now for 8,000. The new machine costs 50,000 and will generate free cash flows of 11,416.55 p.a. over the next 6 years. The corporate tax rate is 35%. The new machine has average risk. GlaxoSmithKline's debt- equity ratio is 0.5 and it plans to maintain a constant debt-equity ratio. GlaxoSmithKline's cost of debt is 5.85% and its cost of equity is 13.10%. The average debt-to-value ratio in the pharmaceutical industry is 20%. What would GlaxoSmithKline's cost of equity be if it took on the average amount of debt of its industry at a cost of debt of 5%? Do this calculation assuming the company does not pay taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts