Question: Can you please help me with QUESTION B. Please write down formula in part B for annuity and where you get each value. PLEASE DON'T

Can you please help me with QUESTION B. Please write down formula in part B for annuity and where you get each value. PLEASE DON'T JUST SEND AN EXCEL TABLE! I also provided my answer to question A. Is it correct (it is needed for question B).

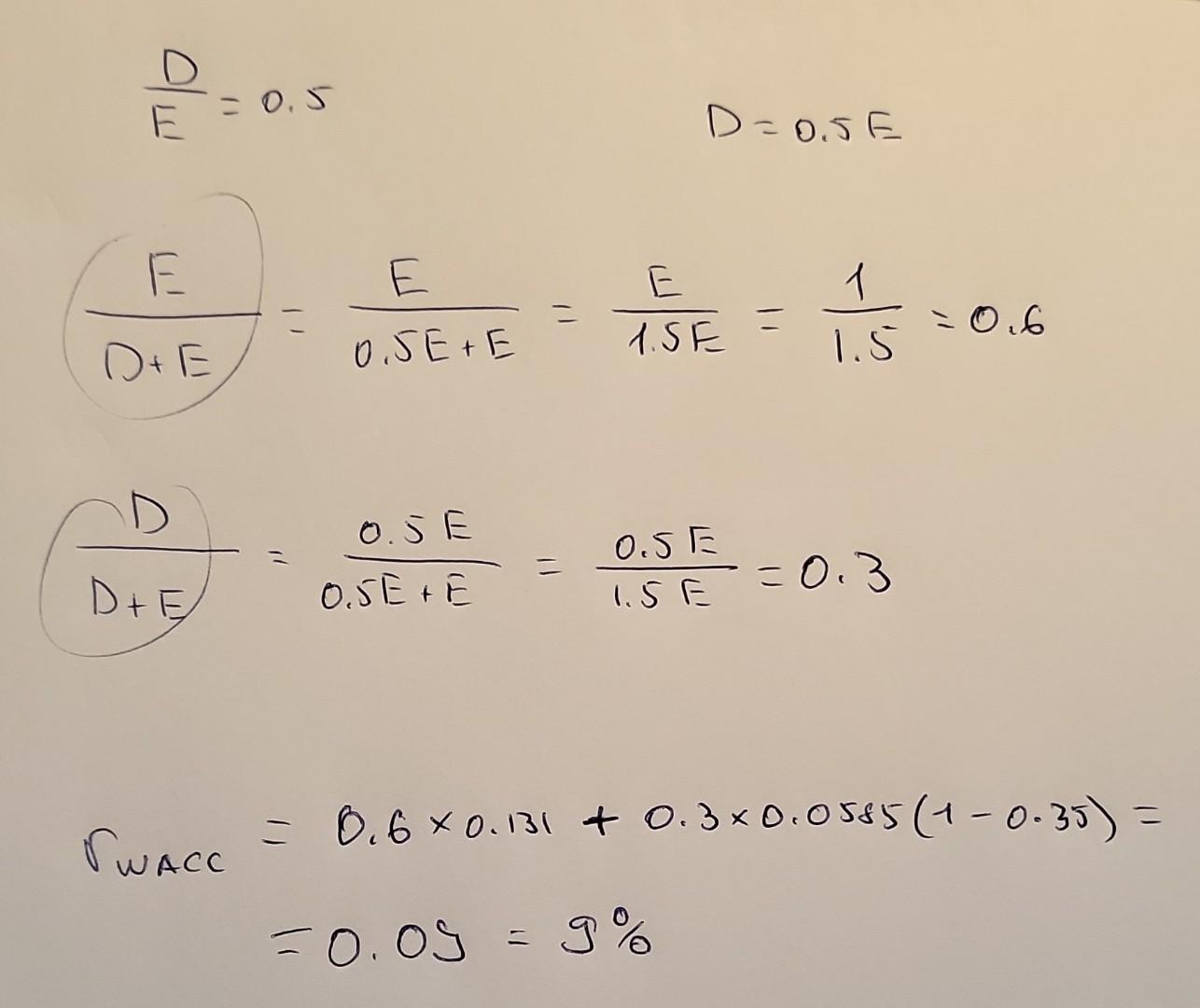

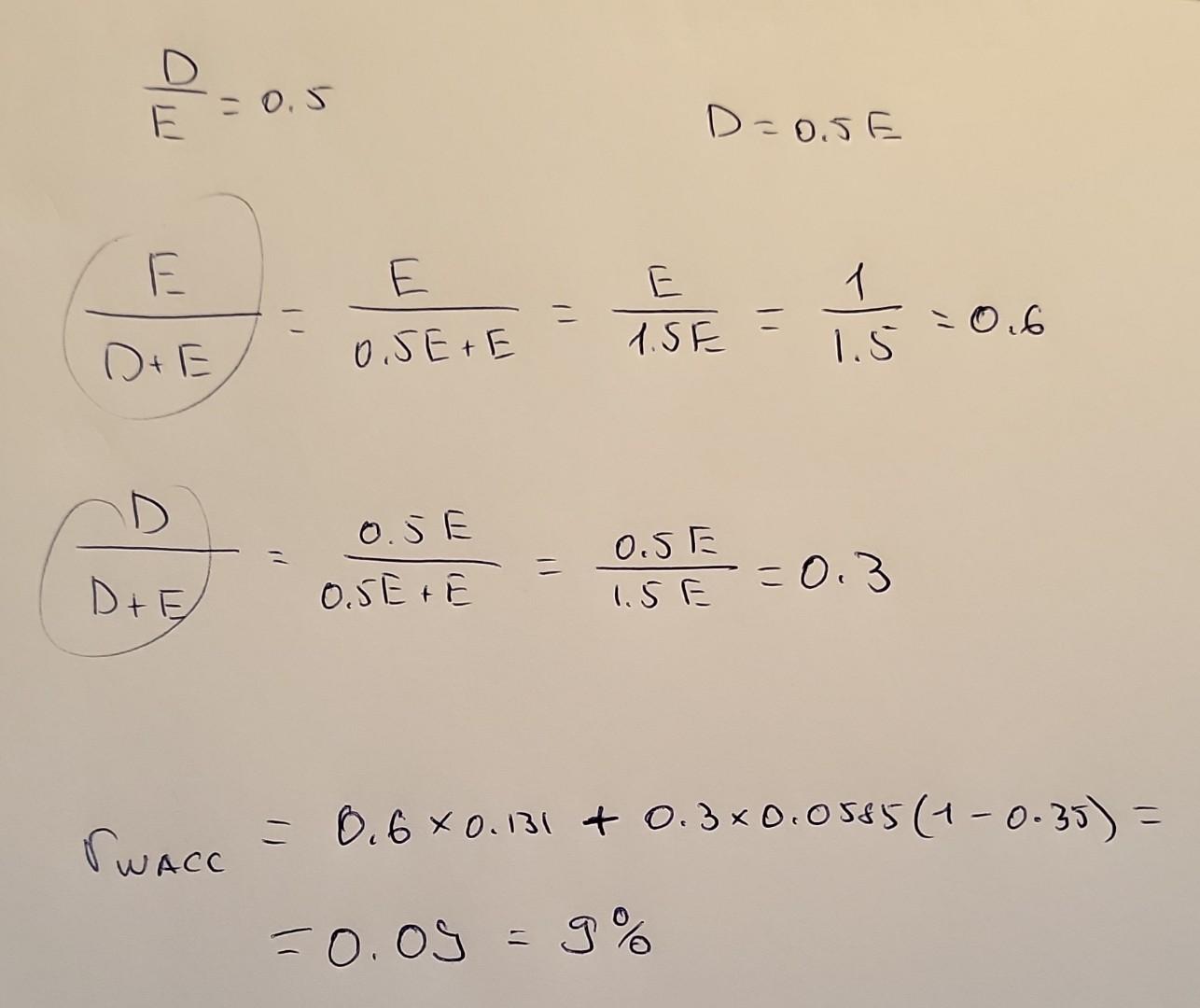

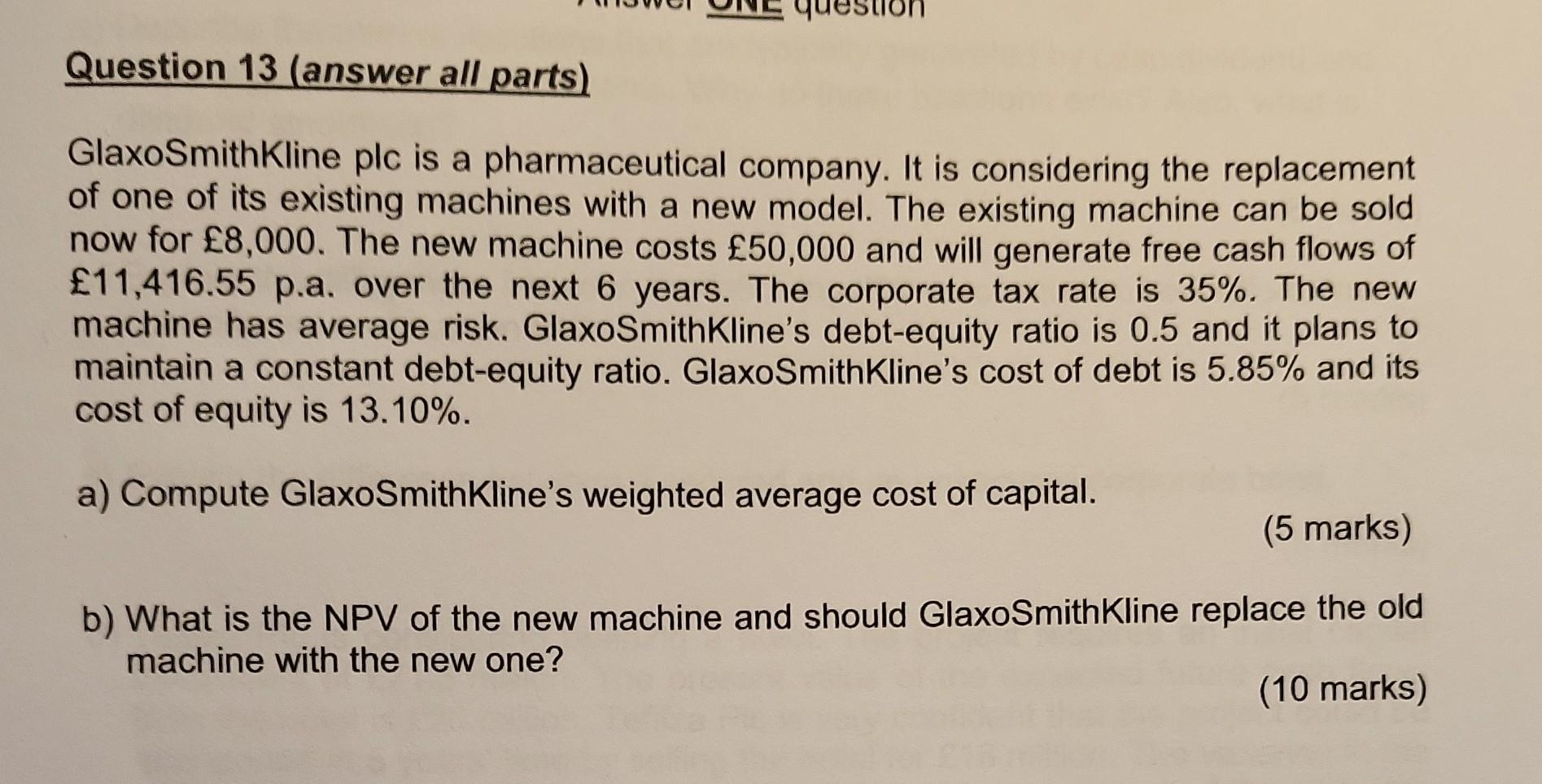

E E D+E = 0.5 D=0.5E E E 1 0.5E+E 1.SE 1.5 0.5 E D+E 0.5E + E 0.SE 1.5E = 0.3 SWACC = 0.6 0.131 +0.30.0585 (1-0-35) = -0.05 9% = 0.6 E E D+E = 0.5 D=0.5E E E 1 0.5E+E 1.SE 1.5 0.5 E D+E 0.5E + E 0.SE 1.5E = 0.3 SWACC = 0.6 0.131 +0.30.0585 (1-0-35) = -0.05 9% = 0.6 Question 13 (answer all parts) GlaxoSmithKline plc is a pharmaceutical company. It is considering the replacement of one of its existing machines with a new model. The existing machine can be sold now for 8,000. The new machine costs 50,000 and will generate free cash flows of 11,416.55 p.a. over the next 6 years. The corporate tax rate is 35%. The new machine has average risk. GlaxoSmithKline's debt-equity ratio is 0.5 and it plans to maintain a constant debt-equity ratio. GlaxoSmithKline's cost of debt is 5.85% and its cost of equity is 13.10%. a) Compute GlaxoSmithKline's weighted average cost of capital. (5 marks) b) What is the NPV of the new machine and should GlaxoSmithKline replace the old machine with the new one? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts