Question: Please note the answers for A, B ,C are wrong. Analysis of Activity Measures Based on the comparative income statement and balance sheet of Cowan

Please note the answers for A, B ,C are wrong.

Please note the answers for A, B ,C are wrong.

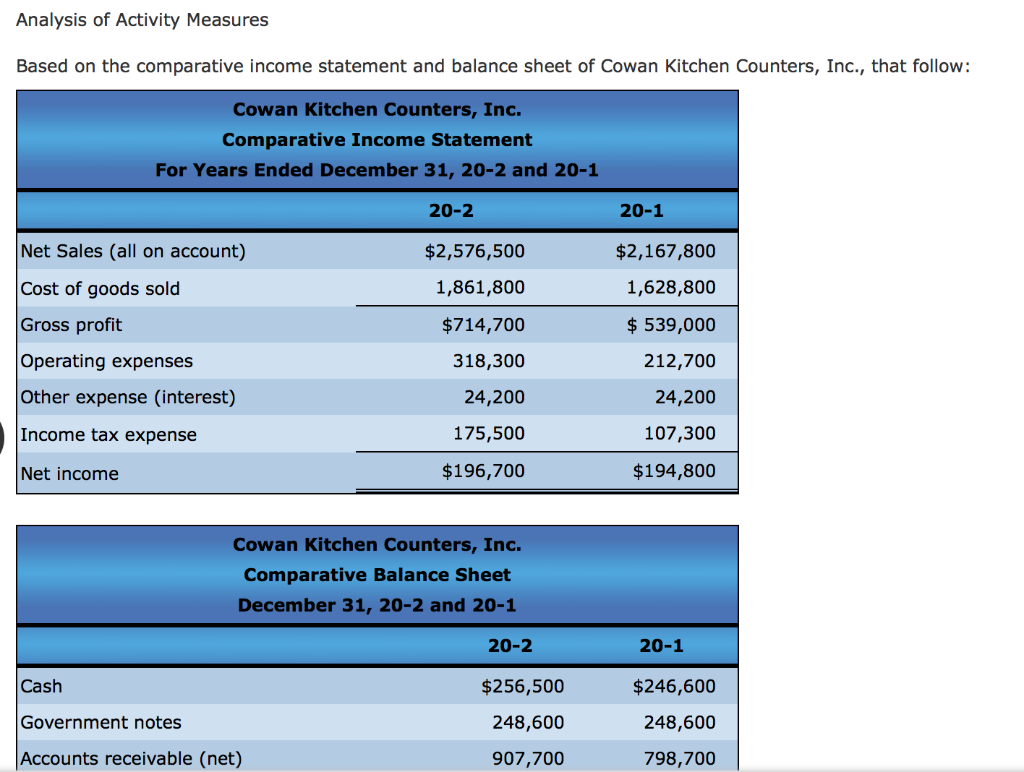

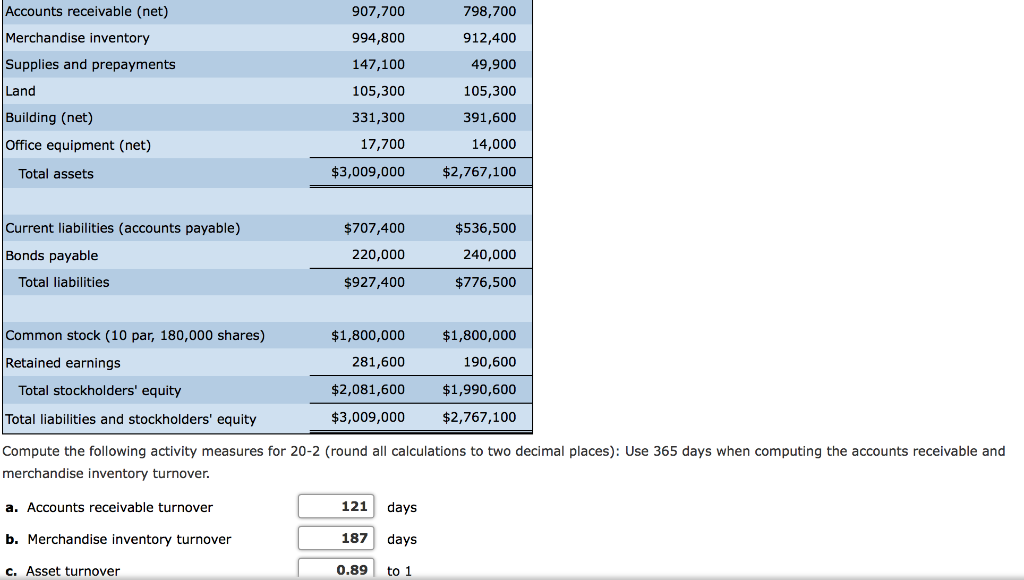

Analysis of Activity Measures Based on the comparative income statement and balance sheet of Cowan Kitchen Counters, Inc., that follow: Cowan Kitchen Counters, Inc. Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 Net Sales (all on account) Cost of goods sold Gross profit Operating expenses Other expense (interest) Income tax expense Net income $2,576,500 1,861,800 $714,700 318,300 24,200 175,500 $196,700 $2,167,800 1,628,800 $539,000 212,700 24,200 107,300 $194,800 Cowan Kitchen Counters, Inc. Comparative Balance Sheet December 31, 20-2 and 20-1 20-2 20-1 Cash Government notes Accounts receivable (net) $256,500 $246,600 248,600 248,600 907,700 798,700 Accounts receivable (net) Merchandise inventory Supplies and prepayments Land Building (net) Office equipment (net) 798,700 912,400 49,900 105,300 391,600 14,000 $3,009,000 $2,767,100 907,700 994,800 147,100 105,300 331,300 17,700 Total assets Current liabilities (accounts payable) $707,400 220,000 $927,400 $536,500 240,000 $776,500 Bonds payable Total liabilities $1,800,000 281,600 $2,081,600 $3,009,000 $1,800,000 190,600 $1,990,600 $2,767,100 Common stock (10 par, 180,000 shares) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Compute the following activity measures for 20-2 (round all calculations to two decimal places): Use 365 days when computing the accounts receivable and merchandise inventory turnover a. Accounts receivable turnover b. Merchandise inventory turnover c. Asset turnover 121 days 187 days 0.89 to 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts