Question: Please note the numbers may change from one question to another. A publisher sells books to Barnes & Noble at $ 1 4

Please note the numbers may change from one question to another.

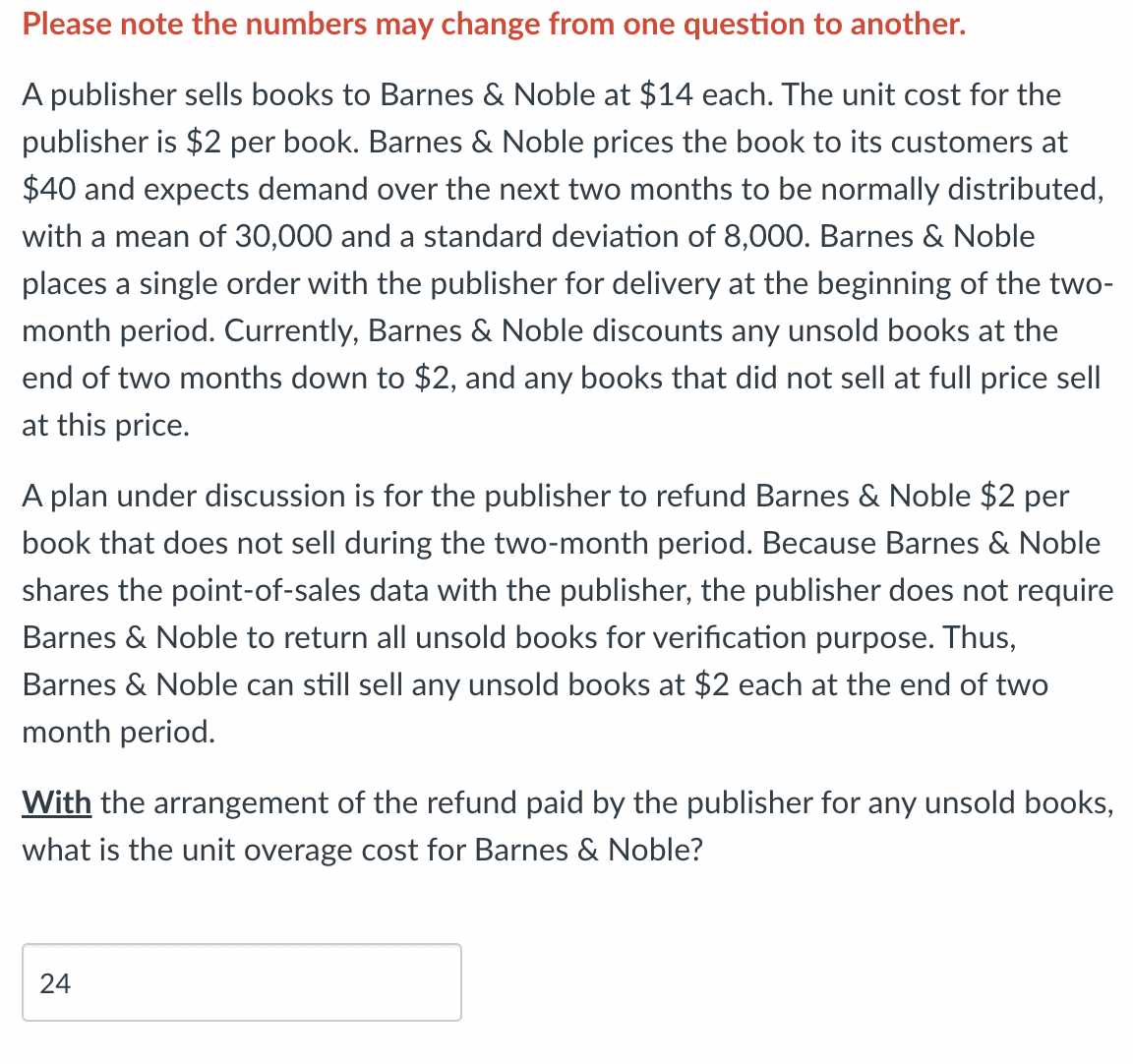

A publisher sells books to Barnes & Noble at $ each. The unit cost for the publisher is $ per book. Barnes & Noble prices the book to its customers at $ and expects demand over the next two months to be normally distributed, with a mean of and a standard deviation of Barnes & Noble places a single order with the publisher for delivery at the beginning of the twomonth period. Currently, Barnes & Noble discounts any unsold books at the end of two months down to $ and any books that did not sell at full price sell at this price.

A plan under discussion is for the publisher to refund Barnes & Noble $ per book that does not sell during the twomonth period. Because Barnes & Noble shares the pointofsales data with the publisher, the publisher does not require Barnes & Noble to return all unsold books for verification purpose. Thus, Barnes & Noble can still sell any unsold books at $ each at the end of two month period.

With the arrangement of the refund paid by the publisher for any unsold books, what is the unit overage cost for Barnes & Noble?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock