Question: please number them with answer. answer fast will leave good rating. Baker & Co. has applied for a loan from the Trust Us Bank to

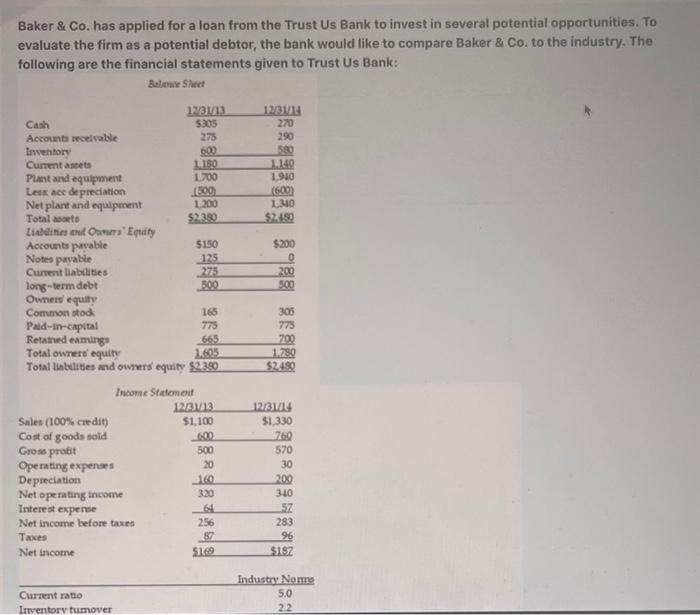

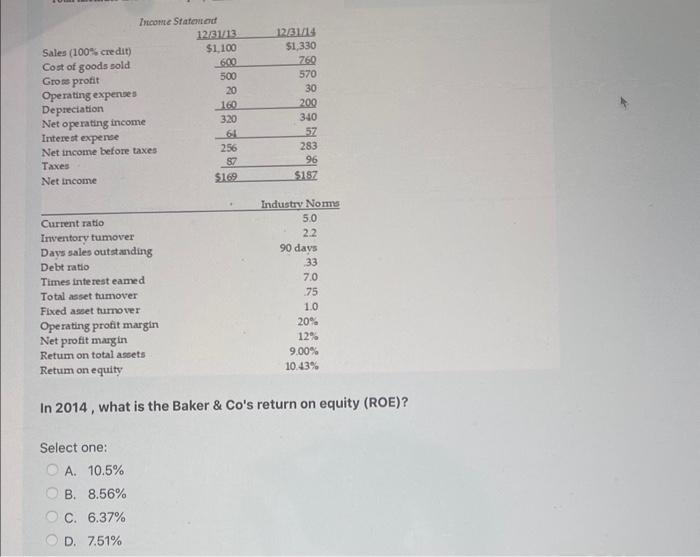

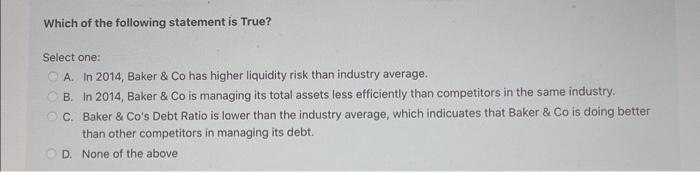

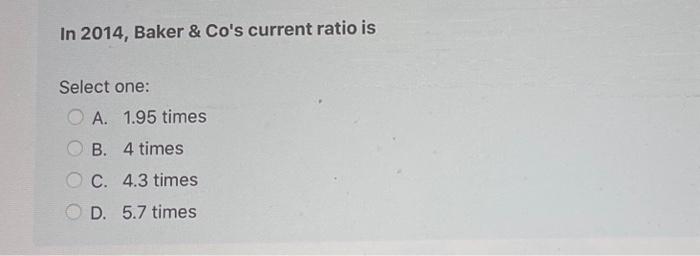

Baker \& Co. has applied for a loan from the Trust Us Bank to invest in several potential opportunities. To evaluate the firm as a potential debtor, the bank would like to compare Baker 8 Co. to the industry. The following are the financial statements given to Trust Us Bank: In 2014, what is the Baker \& Co's return on equity (ROE)? Select one: A. 10.5% B. 8.56% C. 6.37% D. 7.51% Which of the following statement is True? Select one: A. In 2014, Baker & Co has higher liquidity risk than industry average. B. In 2014, Baker \& Co is managing its total assets less efficiently than competitors in the same industry. C. Baker \& Co's Debt Ratio is lower than the industry average, which indicuates that Baker \& Co is doing better than other competitors in managing its debt. D. None of the above In 2014, Baker \& Co's current ratio is Select one: A. 1.95 times B. 4 times C. 4.3 times D. 5.7 times In 2014, what is the total asset turnover ratio? Select one: A. 0.8 times B. 1.5 times C. 0.55 times D. 1.2 times In 2014 , what is Baker & Co's net profit margin Select one: A. 12.5% B. 14.06% C. 11.15% D. 9.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts