Question: please only answer if you are knowledgeable in advanced accounting. please also follow the format of the table when solving the question. thanks Paper Corp.

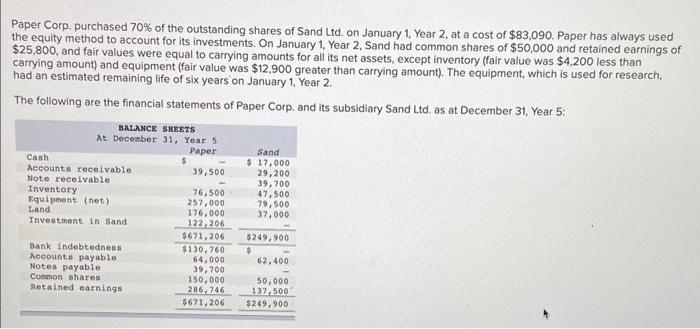

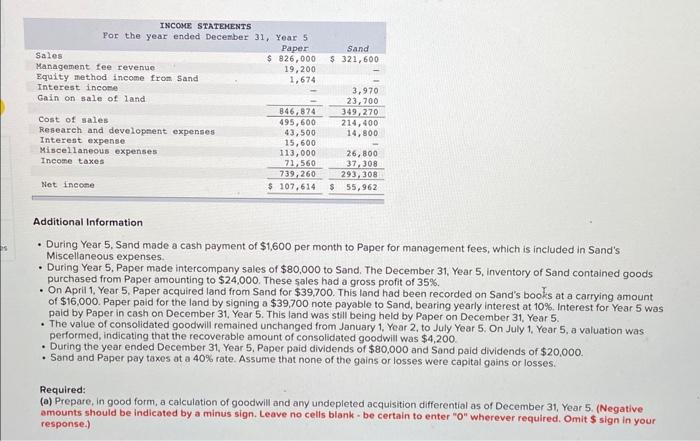

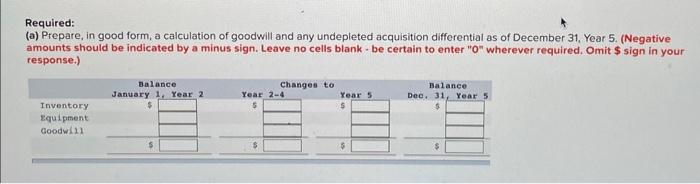

Paper Corp. purchased 70% of the outstanding shares of Sand Ltd. on January 1, Year 2, at a cost of $83,090. Paper has always used the equity method to account for its investments. On January 1, Year 2, Sand had common shares of $50,000 and retained earnings of $25,800, and fair values were equal to carrying amounts for all its net assets, except inventory (fair value was $4,200 less than carrying amount) and equipment (fair value was $12,900 greater than carrying amount). The equipment, which is used for research, had an estimated remaining life of six years on January 1 , Year 2. The following are the financial statements of Paper Corp. and its subsidiary Sand Ltd. as at December 31 , Year 5 : Additional Information - During Year 5, Sand made a cash payment of $1,600 per month to Paper for management fees, which is included in Sand's Miscellaneous expenses. - During Year 5, Paper made intercompany sales of $80,000 to Sand. The December 31, Year 5 , inventory of Sand contained goods purchased from Paper amounting to $24,000. These sales had a gross profit of 35%. - On April 1, Year 5, Paper acquired land from Sand for $39,700. This land had been recorded on Sand's books at a carrying amount of $16,000. Paper paid for the land by signing a $39,700 note payable to Sand, bearing yearly interest at 10%, Interest for Year 5 was paid by Paper in cash on December 31, Year 5 . This land was still being held by Paper on December 31, Year 5. - The value of consolidated goodwill remained unchanged from January 1, Year 2, to July Year 5 . On July 1, Year 5, a valuation was performed, indicating that the recoverable amount of consolidated goodwill was $4,200. - During the year ended December 31, Year 5, Paper paid dividends of $80,000 and Sand paid dividends of $20,000. - Sand and Paper pay taxas at a 40% rate. Assume that none of the gains or losses were capital gains or losses. Required: (a) Prepare, in good form, a calculation of goodwill and any undepleted acquisition differential as of December 31, Year 5, (Negative amounts should be indicated by a minus sign. Leave no cells blank - be certain to enter " O " wherever required, Omit $ sign in your response.) Required: (a) Prepare, in good form, a calculation of goodwill and any undepleted acquisition differential as of December 31, Year 5 . (Negative amounts should be indicated by a minus sign. Leave no cells blank-be certain to enter " 0 " wherever required. Omit $ sign in your response.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts