Question: please only answer if you can show work and work through the entire problem! thank you guys so much! Question 1 John has a coefficient

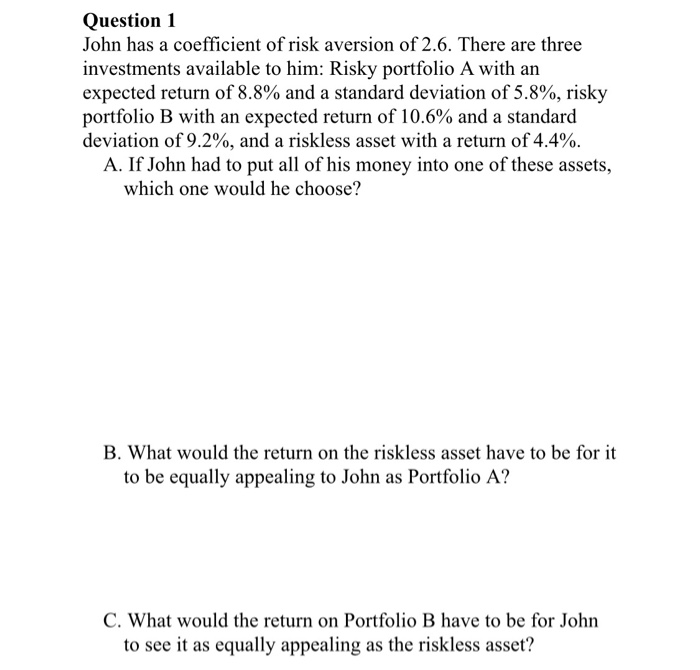

Question 1 John has a coefficient of risk aversion of 2.6. There are three investments available to him: Risky portfolio A with an expected return of 8.8% and a standard deviation of 5.8%, risky portfolio B with an expected return of 10.6% and a standard deviation of 9.2%, and a riskless asset with a return of 4.4%. A. If John had to put all of his money into one of these assets, which one would he choose? B. What would the return on the riskless asset have to be for it to be equally appealing to John as Portfolio A? C. What would the return on Portfolio B have to be for John to see it as equally appealing as the riskless asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts