Question: please only answer if you can show work and work through the entire problem! thank you guys so much! Question 2 Risky Asset 1 Risky

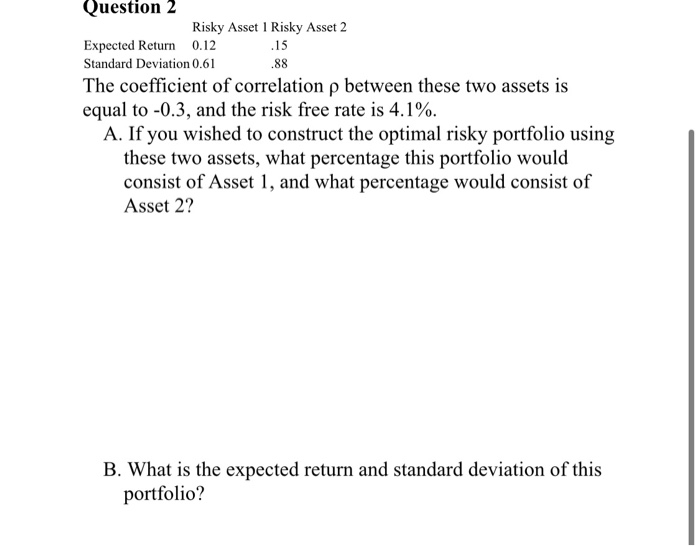

Question 2 Risky Asset 1 Risky Asset 2 Expected Return 0.12 .15 Standard Deviation 0. 61 8 8 The coefficient of correlation p between these two assets is equal to -0.3, and the risk free rate is 4.1%. A. If you wished to construct the optimal risky portfolio using these two assets, what percentage this portfolio would consist of Asset 1, and what percentage would consist of Asset 2? B. What is the expected return and standard deviation of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts