Question: Please, only answer if you have the CORRECT ANSWER to the question. if your answer is wrong or irrelevant, I will REPORT it to Chegg

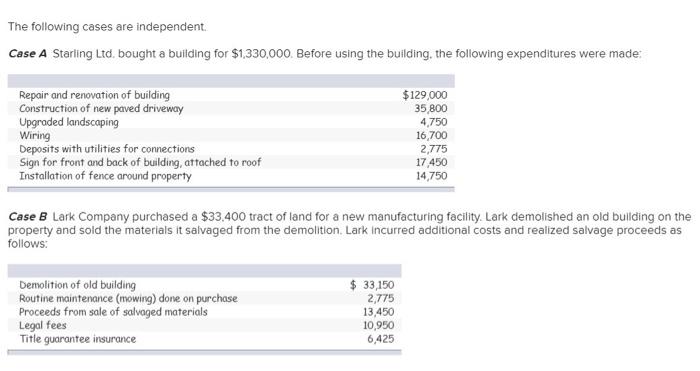

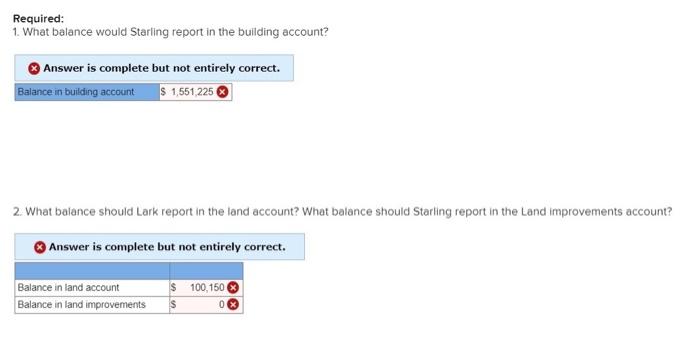

The following cases are independent. Case A Starling Ltd. bought a building for $1,330,000. Before using the building, the following expenditures were made: Repair and renovation of building Construction of new paved driveway Upgraded landscaping Wiring Deposits with utilities for connections Sign for front and back of building, attached to roof $129,000 35,800 4,750 16,700 2,775 17,450 14,750 Installation of fence around property Case B Lark Company purchased a $33.400 tract of land for a new manufacturing facility. Lark demolished an old building on the property and sold the materials it salvaged from the demolition. Lark incurred additional costs and realized salvage proceeds as follows: Demolition of old building Routine maintenance (mowing) done on purchase Proceeds from sale of salvaged materials Legal fees Title guarantee insurance $ 33,150 2,775 13,450 10,950 6,425

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts