Question: Please only answer if you know the answer 100%. Answer all or I will down vote. 2 pts Question 36 Richard has individual health Insurance

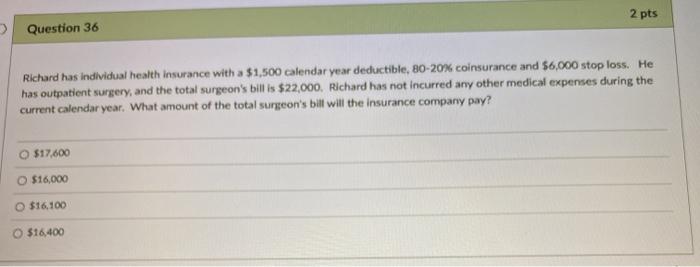

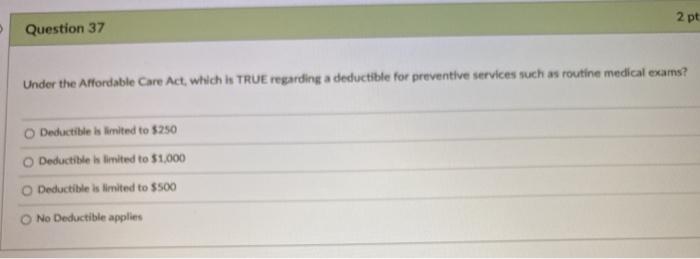

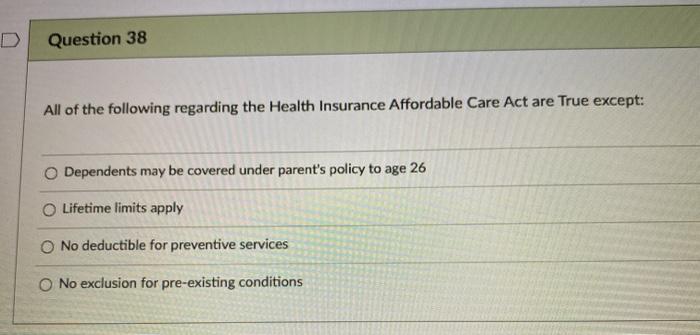

2 pts Question 36 Richard has individual health Insurance with a $1,500 calendar year deductible, 80-20% coinsurance and $6,000 stop loss. He has outpatient surgery, and the total surgeon's bill is $22,000. Richard has not incurred any other medical expenses during the current calendar year. What amount of the total surgeon's bill will the insurance company pay? $17.600 O $16,000 O $16.100 $16,400 2pt Question 37 Under the Affordable Care Act, which is TRUE regarding a deductible for preventive services such as routine medical exams? Deductible is limited to $250 Deductible is limited to $1,000 Deductible is limited to $500 No Deductible applies D Question 38 All of the following regarding the Health Insurance Affordable Care Act are True except: Dependents may be covered under parent's policy to age 26 Lifetime limits apply No deductible for preventive services No exclusion for pre-existing conditions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts