Question: Please only answer part B! Jackson, a self-employed taxpayer, uses his automobile 90% for business and during 2020 drove a total of 15,000 business miles.

Please only answer part B!

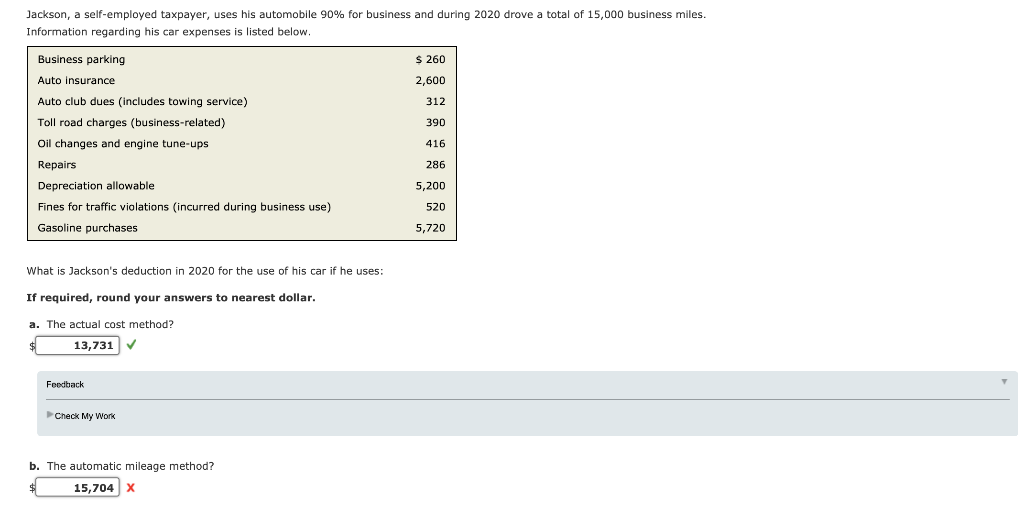

Jackson, a self-employed taxpayer, uses his automobile 90% for business and during 2020 drove a total of 15,000 business miles. Information regarding his car expenses is listed below. $ 260 2,600 312 390 Business parking Auto insurance Auto club dues (includes towing service) Toll road charges (business-related) Oil changes and engine tune-ups Repairs Depreciation allowable Fines for traffic violations (incurred during business use) Gasoline purchases 416 286 5,200 520 5,720 What is Jackson's deduction in 2020 for the use of his car if he uses: If required, round your answers to nearest dollar. a. The actual cost method? 13,731 Feedback Check My Work b. The automatic mileage method? 15,704

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts