Question: plzz do the one i get wrong Jackson, a self-employed taxpayer, uses his automobile 90% for business and during 2022 drove a total of 14,000

plzz do the one i get wrong

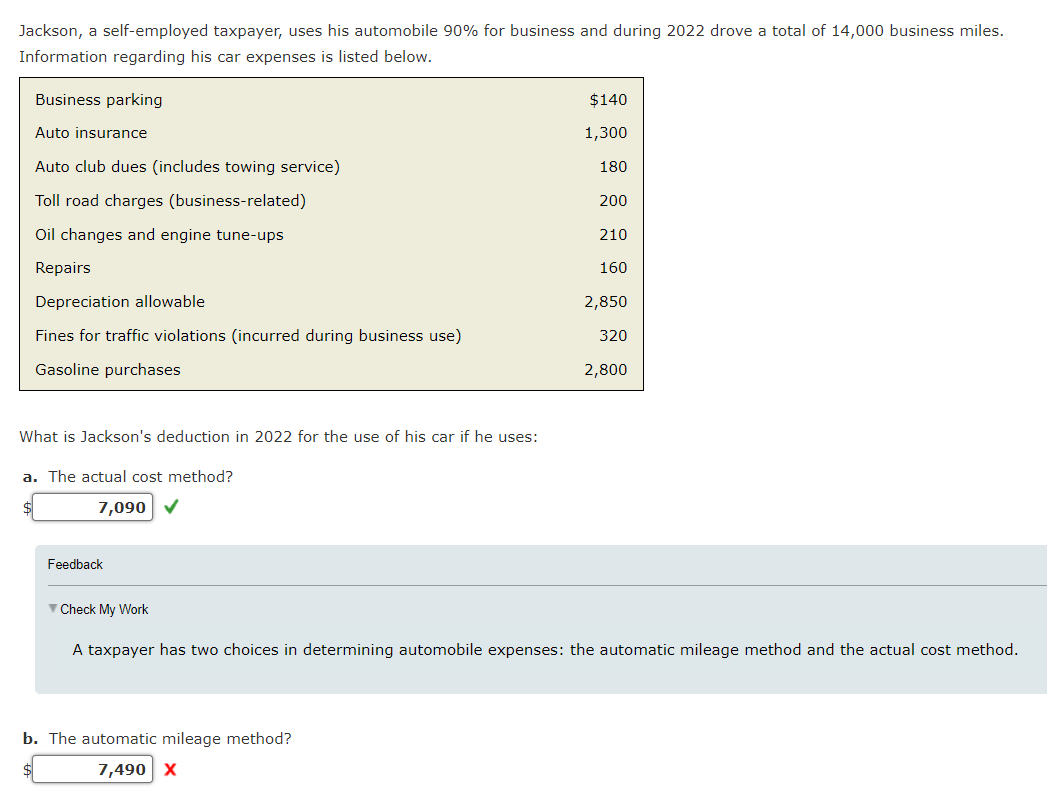

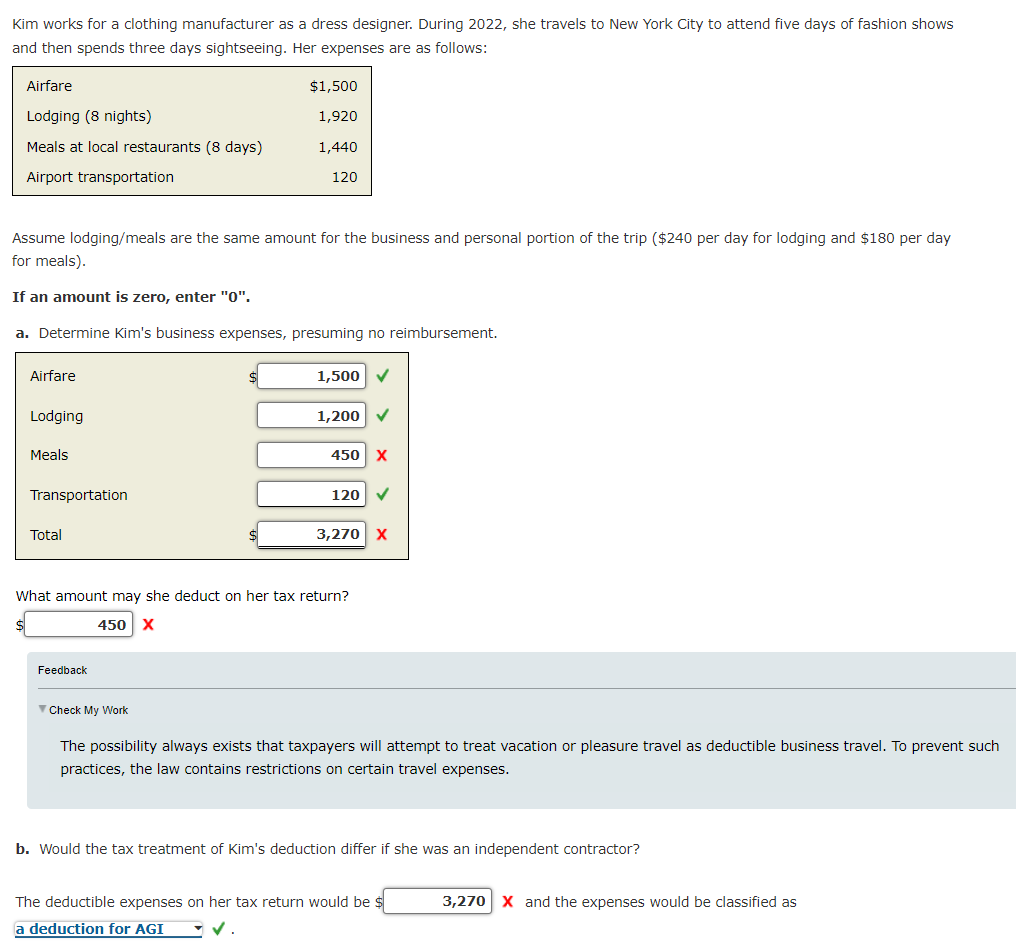

Jackson, a self-employed taxpayer, uses his automobile 90% for business and during 2022 drove a total of 14,000 business miles. Information regarding his car expenses is listed below. What is Jackson's deduction in 2022 for the use of his car if he uses: a. The actual cost method? s Feedback Check My Work A taxpayer has two choices in determining automobile expenses: the automatic mileage method and the actual cost method. b. The automatic mileage method? x Kim works for a clothing manufacturer as a dress designer. During 2022, she travels to New York City to attend five days of fashion shows and then spends three days sightseeing. Her expenses are as follows: Assume lodging/meals are the same amount for the business and personal portion of the trip ( $240 per day for lodging and $180 per day for meals). If an amount is zero, enter " 0 ". a. Determine Kim's business expenses, presuming no reimbursement. What amount may she deduct on her tax return? \& x Feedback Check My Work The possibility always exists that taxpayers will attempt to treat vacation or pleasure travel as deductible business travel. To prevent such practices, the law contains restrictions on certain travel expenses. b. Would the tax treatment of Kim's deduction differ if she was an independent contractor? The deductible expenses on her tax return would be \$ X and the expenses would be classified as

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts